CTW22

Commodity Trading Annual Industry Survey 2022

We cooperated with some of the industry’s leading commentators to provide analysis, and bring data to life on Commodities Trading.

Tomorrow’s Company: What does an ESG Optimized Organization Look Like?

A sustainability expert, an HR professional and risk professional talk about how tomorrow’s “ideal” company will look and function. Abide by ESG Covenants to be more investment worthy. Full recognition of end user preferences linking that back to production and throughout the value chain. Recognition of value pockets throughout the ...

A Golden Era of Fraud and Financial Crime in Commodity Trade?

• Why has the pandemic been an enabler to increased fraud and risk? • Cyber defence – what does the CTF community need to know and do? • Lessons learned from recent high profile cases • Where can new technologies play a role in mitigating these risks?

Sustainable Trade Finance – The Road Ahead

• Evolution not revolution? Adapting traditional trade mechanisms whilst driving change • Demonstrating best practice in climate transparency and calculation of carbon footprints • A look into sustainability linked loans – what is available and what products/structures are likely to emerge? • What are the opportunities of climate finance in ...

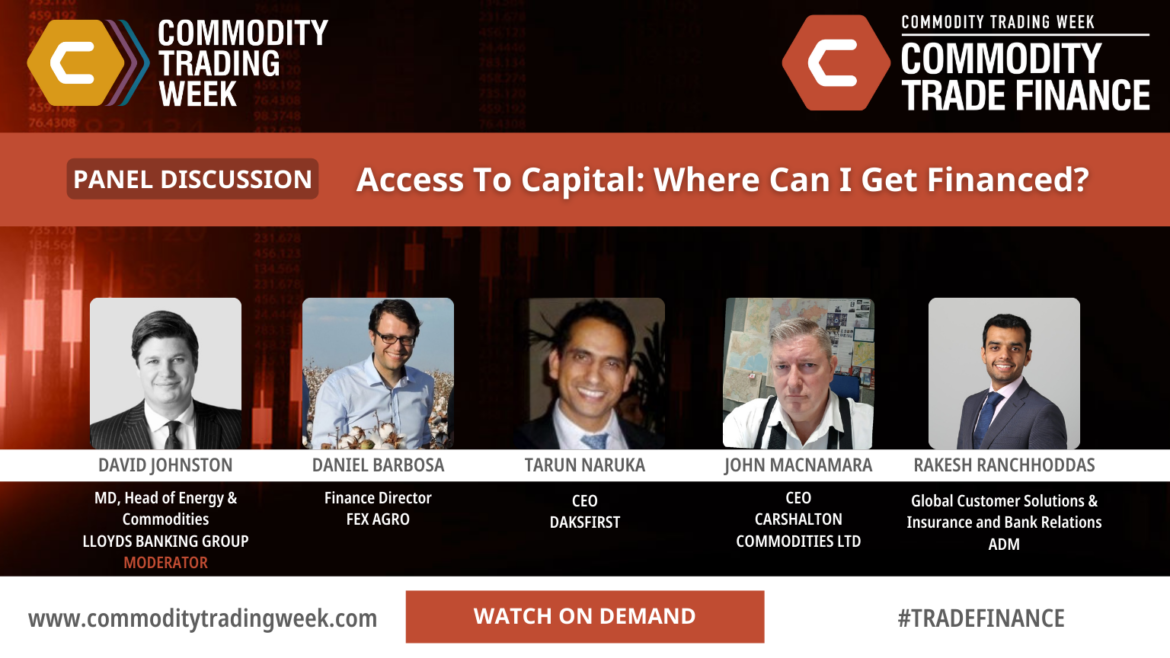

Access to Capital: Where Can I Get Financed?

• How have events in Ukraine impacted the global market for commodity trade finance? • Should investors & lenders fear the ‘structured LC’ or are they an important part of the mix, if done ‘correctly’? • Is traditional financing still feasible for SMEs? What alternative finance mechanisms/ routes are available? ...

Where Next for Digital Innovation in Commodity Trade Finance?

• An overview of notable CTF FinTech on the market today • Evolution or revolution? What is truly most important to the traders and financiers? • Addressing the challenge of digital islands – how can interoperability be enhanced between trade finance tech providers? • Does blockchain have a role? What ...

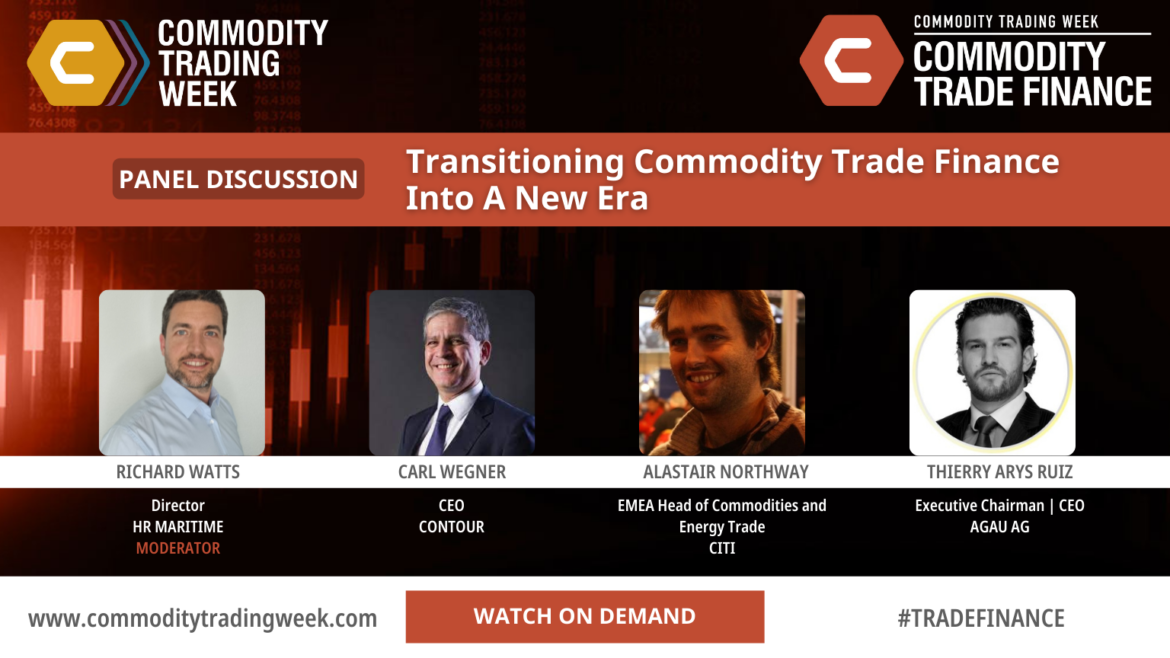

Transitioning Commodity Trade Finance Into a New Era

• Sustainability, supercycles, digitalisation – Impact of key industry megatrends on CTF • What are the key investment and project execution challenges while transitioning to a net zero world and how can we mitigate? • Buckle your seatbelts? The short, medium and long term impacts of the supercycle on financing ...

Financialisation in the Commodity Markets

• There will be a growth in “Outsiders” trading commodity markets, who are primarily treating commodities purely as a financial asset • This will be driven by trends in inflation and asset correlations • This will change the structure of the market. Some of those changes can be predicted.

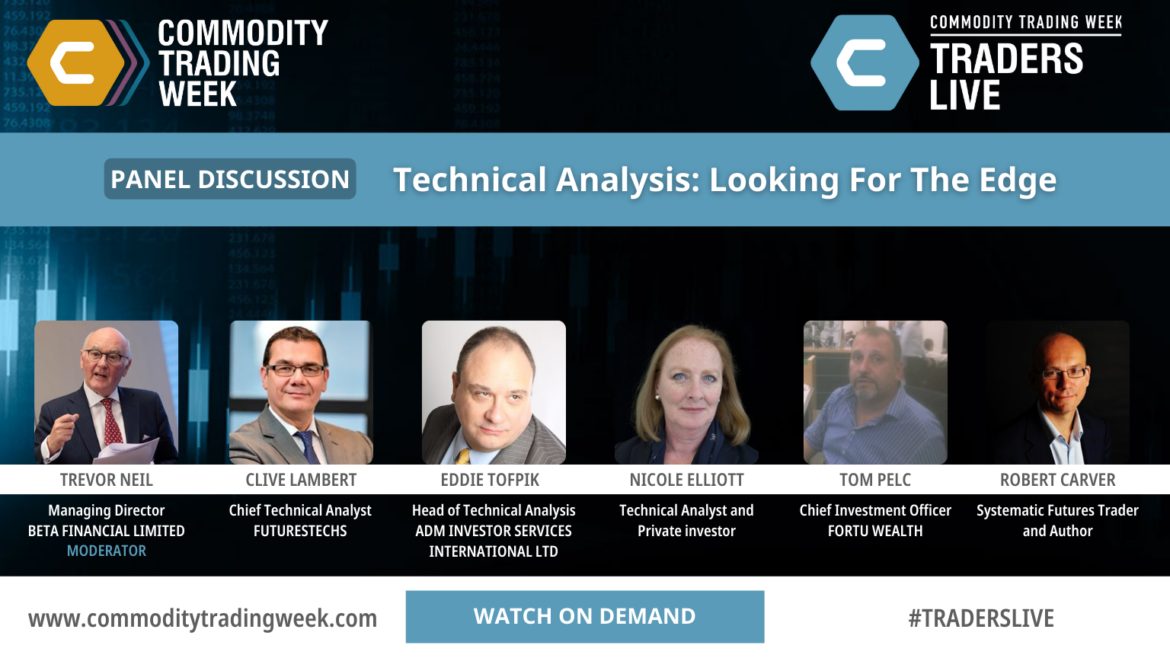

Technical Analysis: Looking for the Edge

• With the increased use of Algo trading, is technical analysis still relevant? • Is liquidity too low in commodity markets for technical analysis to be efficient? Does it work enough so that it MUST be used? • Top technical analysts comment on your markets – The panellists want your ...