CTWA22

Impact of ESG on the Trade Life Cycle

This session looks at the industry view of ESG, essential or “greenwashing”? ESG metrics and benchmarks, and efforts towards industry standardization

Fertilizer Tied to Energy Shift as Supply Shocks Mount

This session discusses whether fertilizers are too big to ignore amid Ukraine crisis, record prices – how can farmers adjust, and energy crunch to dictate nitrogen supply availability

Impacts of Climate Change on Ags Markets

This session discusses an objective look at the past – weather shocks and market reactions, what lies ahead – IPCC climate trends and potential market risks, and considerations for managing future price risk in a changing climate

Commodity Correlation

This session looks at how different industry sectors drive commodity supply and demand, what sectors commodity traders should be watching, and how trends will in areas like construction, aerospace, building products, commercial services, electrical equipment and more drive supply and demand in commodities

Risk Measures for Stressed Markets

This session discusses revisiting fundamental assumptions, improving existing models with minimal effort, and suggestions for better stress testing

A Brief Update on the SEC Rule-Making on Climate Disclosures & What This Means for Trading Companies

This session gives a brief update on the SEC rule-making on climate disclosures & what this means for trading companies

Executive Roundtable

This session looks at the impact of sustainability initiatives on commodity trading companies, combating image issues in an increasingly climate-focused world, impact of sustainability initiatives on investment, and ESG from a leadership perspective/creating a culture of sustainability trading

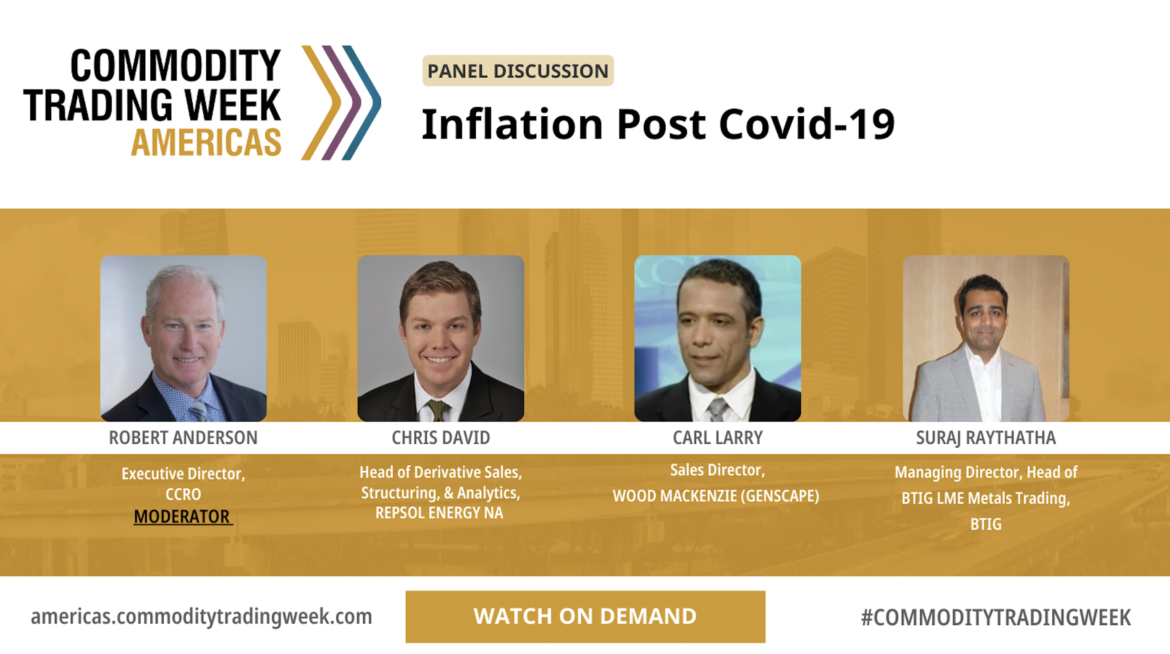

Inflation Post Covid-19

This session looks at post-pandemic blip, or a long term economic crisis, what can we expect from interest rates, and mitigation strategies

Natural Gas and the Net-Zero Revolution

This session looks at the outlook for North American natural gas, the bridge to net zero, LNG markets in the wake of Ukraine war, and RNG/RSG