CTWOnline

New Year, New Risks: What risks are “top of mind” for risk practitioners in 2024 – Commodity Risk & Finance 2024

Discover how high interest rates, inflation, recession risks, geopolitics, regulatory changes, and climate shifts are reshaping market dynamics, with insights from Brock Mosovsky, Eric Twombly, and others

Finding Finance: Exploring the landscape for trade finance in 2024 – Commodity Risk & Finance 2024

Uncover insights on market volatility, evolving ESG requirements, and digitalization in trade finance from experts like Brian Canup, Magdalena Nadar, Sunil George, and Todd Lynady

Advances in Risk Technology – Commodity Risk & Finance 2024

Explore how CTRM/ETRM systems adapt to modern traders’ needs, AI’s role in risk assessment, and the evolution of data management and security with top industry experts.

Commodity Forecasting: Cracking the Crystal Ball: Forecasting the Future of Commodity Pricing

Delve into advanced techniques and technologies for commodity price prediction, including AI and data analytics. Learn how these tools maintain accuracy in volatile markets and their impact on risk mitigation and strategic decision-making in the dynamic world of commodities.

Commodity Forecasting: Navigating the Commodity Trading Universe in 2024 – Insights from Economists

Anticipate 2024’s commodity price trends amid global geopolitical shifts and supply chain recovery. Assess climate change’s impact on commodities and the growing tension between food and fuel demands, influencing market prices and availability.

Commodity Forecasting 2023: Energy Transition Commodities in Focus – Riding the Green Wave

Unraveling the complexities of transitioning to cleaner energy, focusing on key commodities like lithium and hydrogen. Challenges in markets, investment impacts, supply chain risks, and the influence of responsible sourcing on the evolving energy industry are critically examined.

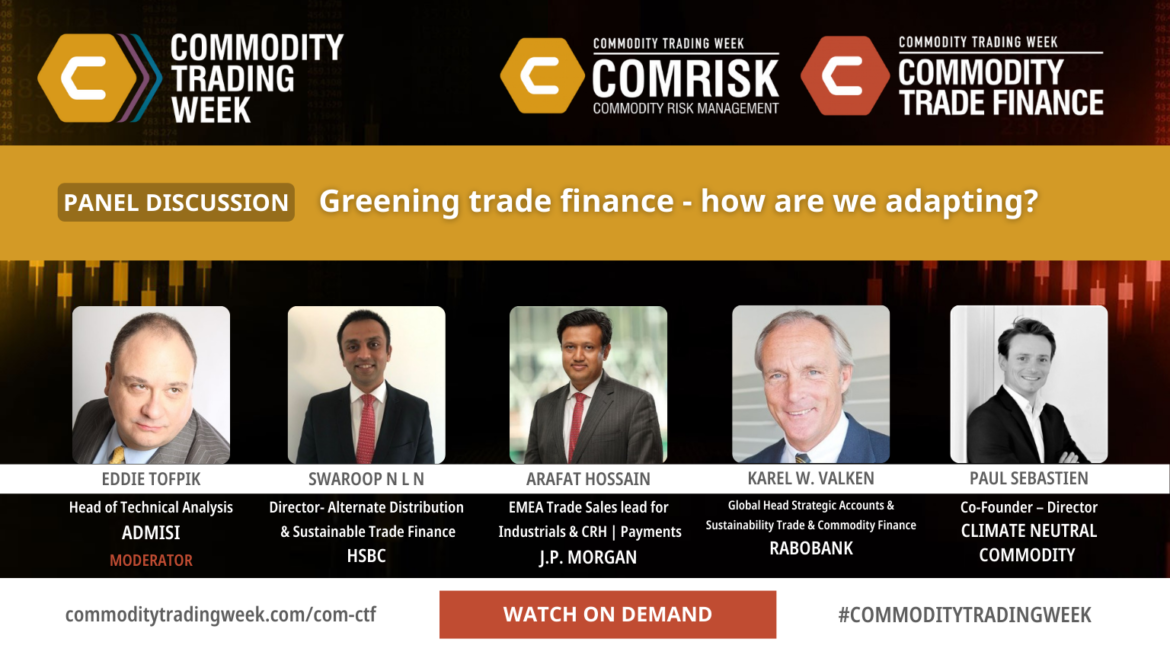

Greening Trade Finance – How Are We Adapting?

Is trade finance becoming more sustainable? ESG and green finance – what does it mean for commodity trade finance? What are the set of standards and guidelines to follow? How to structure trade finance to positively reward ESG-driven investment? How digital technology helps to drive sustainability in trade finance Risks ...

Easing Access to Trade Finance Through Digitalisation

An overview of digital tools in the market and which might be most useful for your organisationToo much or too little data? Applying analytical tools to speed up business processesUtilising AI and ML to support credit assessments – use casesElectronic documentation – what can be improved?Are these solutions interoperable? What ...

Risk Management in Commodity Trading in Unprecedented Times: Take 3 (2023 Edition)

This panel discussion explores how the risk management community is responding to the latest issues impacting the global economy, what are your strategies and how to ensure the resilience of your organisation, risk management challenges going forward; will we ever return to normality as we once knew it?