Finance

Bridging the Finance Gap: Perspective of SMEs

PANEL DISCUSSION: SMEs perspectives – where and how to get financed What are the biggest challenges to access the finance? What are most recent developments in SMEs adopting digital trading tools? What are the alternatives available for SME’s compared to larger industry players? Developing a financing checklist: Best practises for ...

Leaders Panel: Responding To and Thriving Under Abnormal Conditions

PANEL DISCUSSION: This panel will bring together experts from across the trade finance spectrum to assess some of the below challenges, and explore best practises in their mitigation- Incorporation of ESG in the trade finance– The volatility of the capital markets– Inflationary pressures– High geopolitical instability– The impact of the ...

Commodity Trade Finance in Disrupted Times

PANEL DISCUSSION: Overview of trade finance in 2023 and beyond Inflation and its’ effect on lending rates Impact of war, the geopolitical situation PANEL: Aaron Zwiebach, Vice President, Evolution Credit Partners

Exploring Digital Trading Platforms and Ecosystems: Driving an Industry in a Sea of Change?

PANEL DISCUSSION: Which notable platforms and ecosystems are developing to help digitise trade finance? How will these platforms develop in the next 2 years? Understanding security issues and standards PANEL: Moderator: Deepesh Patel, Director, Trade Finance Global Luke Humphrey, Global Head, CIO Digital Technology and Analytics, Louis Dreyfus Company Sean ...

Impact of Extreme Volatility on Large Trading Companies

How are company leaders positioning themselves in an era of high prices and extreme volatility? How has the war on Ukraine impacted different markets? How will this impact markets in the long term? What are the lingering impacts of COVID-19? Are supply chains springing back, and if not, how long ...

Greener Dollars: Sustainable Finance

How are lenders viewing ESG ratings and trade specific carbon footprints? Evolution not revolution? Adapting traditional trade mechanisms whilst driving change. Demonstrating best practice in climate transparency and calculation of carbon footprints. What are the opportunities of climate finance in emerging markets?

A Golden Era of Fraud and Financial Crime in Commodity Trade?

• Why has the pandemic been an enabler to increased fraud and risk? • Cyber defence – what does the CTF community need to know and do? • Lessons learned from recent high profile cases • Where can new technologies play a role in mitigating these risks?

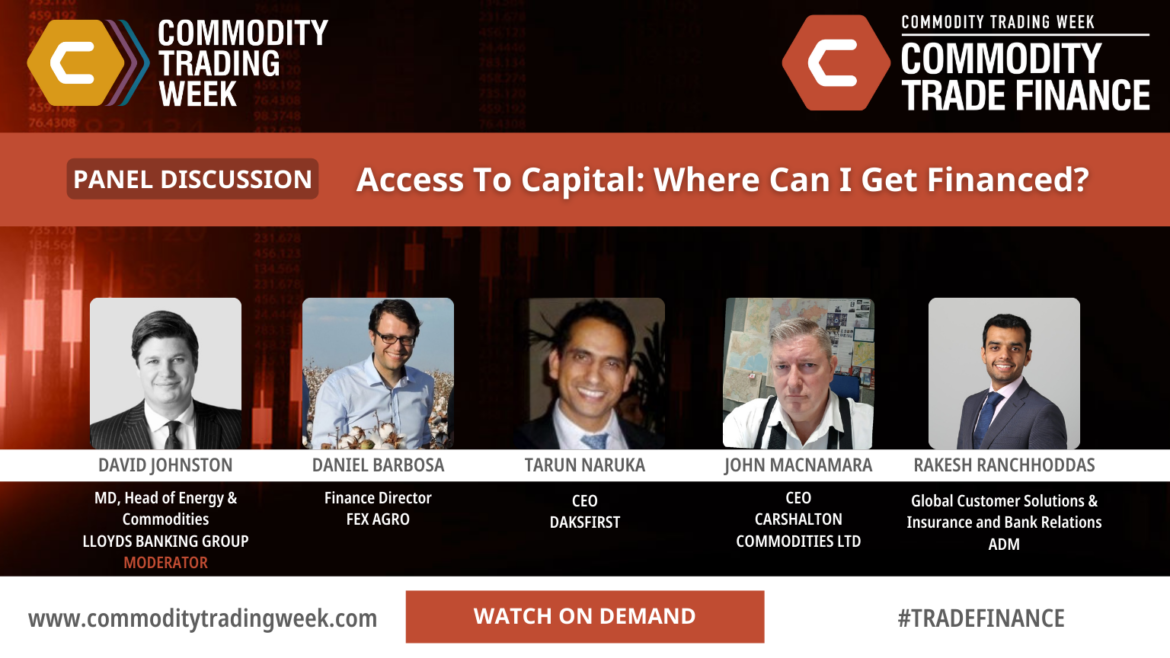

Access to Capital: Where Can I Get Financed?

• How have events in Ukraine impacted the global market for commodity trade finance? • Should investors & lenders fear the ‘structured LC’ or are they an important part of the mix, if done ‘correctly’? • Is traditional financing still feasible for SMEs? What alternative finance mechanisms/ routes are available? ...

Financialisation in the Commodity Markets

• There will be a growth in “Outsiders” trading commodity markets, who are primarily treating commodities purely as a financial asset • This will be driven by trends in inflation and asset correlations • This will change the structure of the market. Some of those changes can be predicted.