full content

ESG and Climate Change – the Risk Managers Perspective

• Climate risk scenario modelling • Managing exposure to carbon and other environmental markets • Greenwasher! And other reputational risks to consider • Calculating your carbon footprint and understanding your climate credit rating • Sustainable financing: staying ahead of the curve

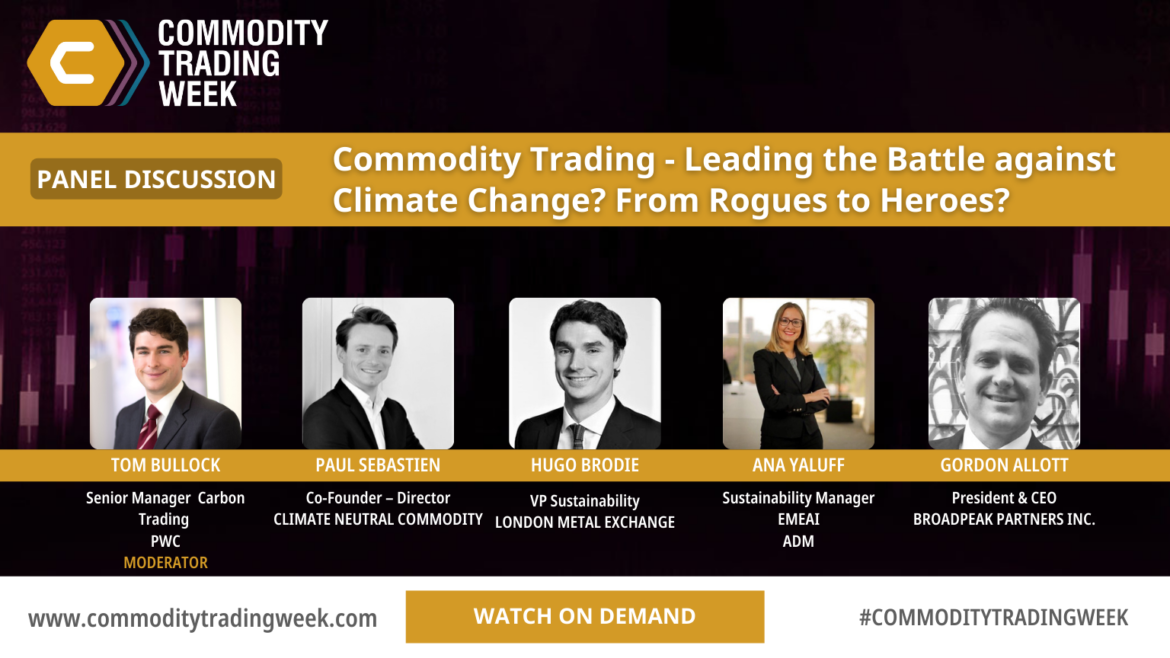

Commodity Trading – Leading the Battle Against Climate Change? From Rogues to Heroes?

• Development of ‘green’ commodity markets: drivers, perspectives • The role to play for the commodity industry to support the emergence of low carbon markets • Environmental/carbon neutral claims: standardisation, verification, transparency for credible claims • Life cycle carbon footprint calculation, reporting: complexity, good/best practices, industry standards

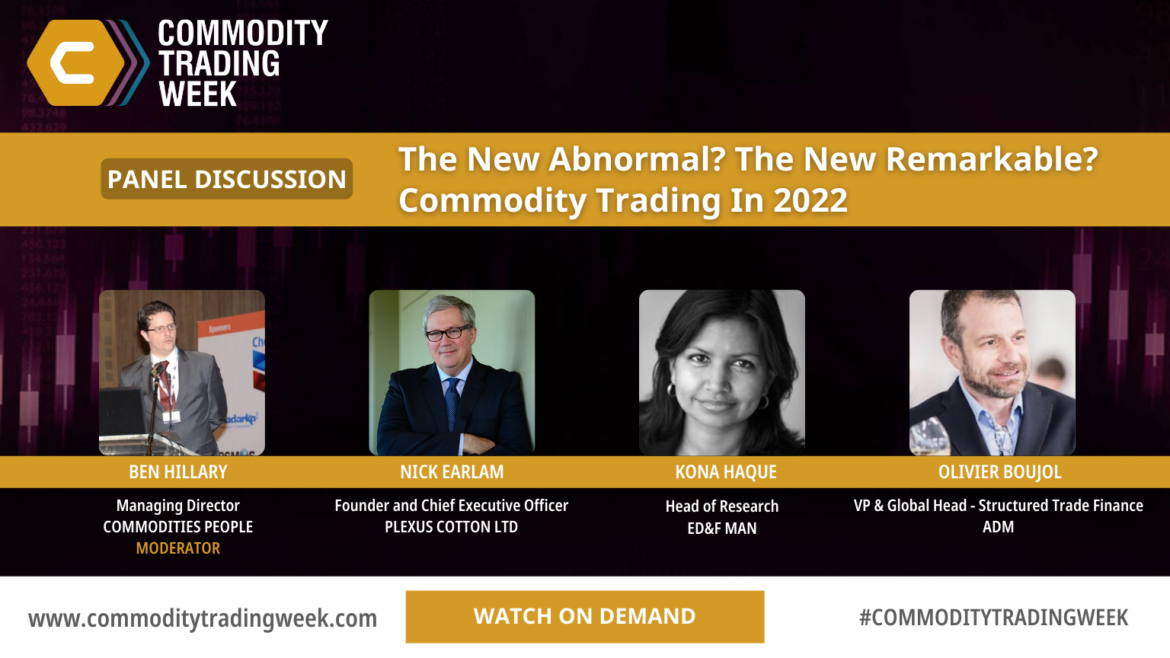

The New Abnormal? The New Remarkable? Commodity Trading in 2022

• What is fueling the commodity supercycle… and how long can it last? • Inflation, labour shortages, supply chain chaos – what does ‘post pandemic’ look like and how long will its effects be felt? • Impact of the arrival of the traditional and national exporters, importers into the trading ...

Real Time Risk Management in Ultra-Volatile Times

This highly practical webinar will bring together some of the commodity trading sectors foremost risk leaders, to highlight the greatest dangers on the horizon, and how new cutting edge technologies can not only guard you against these dangers, but to also provide you with an opportunity to securely thrive and ...

Driving the Transition through ESG Finance

• What are the carrots, and what are the sticks that traders can expect from the financial sector in the years ahead? • Integrating ESG into banking frameworks – realistic rates of change • What are the key drivers of change in the financial landscape? • Emerging products and structures ...

New Era in Commodity Trade Finance

• Sustainability, super cycles, digitalisation – Impact of key industry megatrends on commodity trade finance • What are the key investment and project execution challenges while transitioning to a net zero world and how can we mitigate them? • Speeding up with innovation- is digitisation in trade finance the great ...

Economic Analysis and Impact on Recovery and Global Markets

• How does global economic recovery after Covid-19 look like? • Regional overview: Europe, Asia and US • New trade relations and sanctions – what do you need to know and follow • China’s economic rebound and where recovery is heading

Global Supply Chain Chaos Management

• Exploring the ‘perfect storm’ of supply and demand mismatch Short term volatility… long term supercycles – assessing current market scenarios • Developing new strategies to counter the resource scarcity crisis; Manpower, machines, materials, transportation, fuel and more • The ongoing effects of Covid19 on the supply chain disruptions. When ...

ESG and Climate Change in Commodity Trading – the Risk Managers Perspective

• How trading businesses can support the emergence of low carbon markets • Environmental and carbon neutral claims: standardisation, verification, transparency and reputational risk • Life cycle carbon footprint calculation, reporting: complexity, good/best practices, industry standards • What about sustainability? Controlling the impact on trading and market risk management as ...