Monthly Sessions

Commodity Trading Week London 2023 Online Premier

After the successful hosting of Commodity Trading Week in London from April 25-26, which saw an unprecedented turnout of attendees from the commodity trading sector, we are thrilled to provide access to all the exceptional content from the event online. During our live online premier of Commodity Trading Week, we announced the Rising Star ...

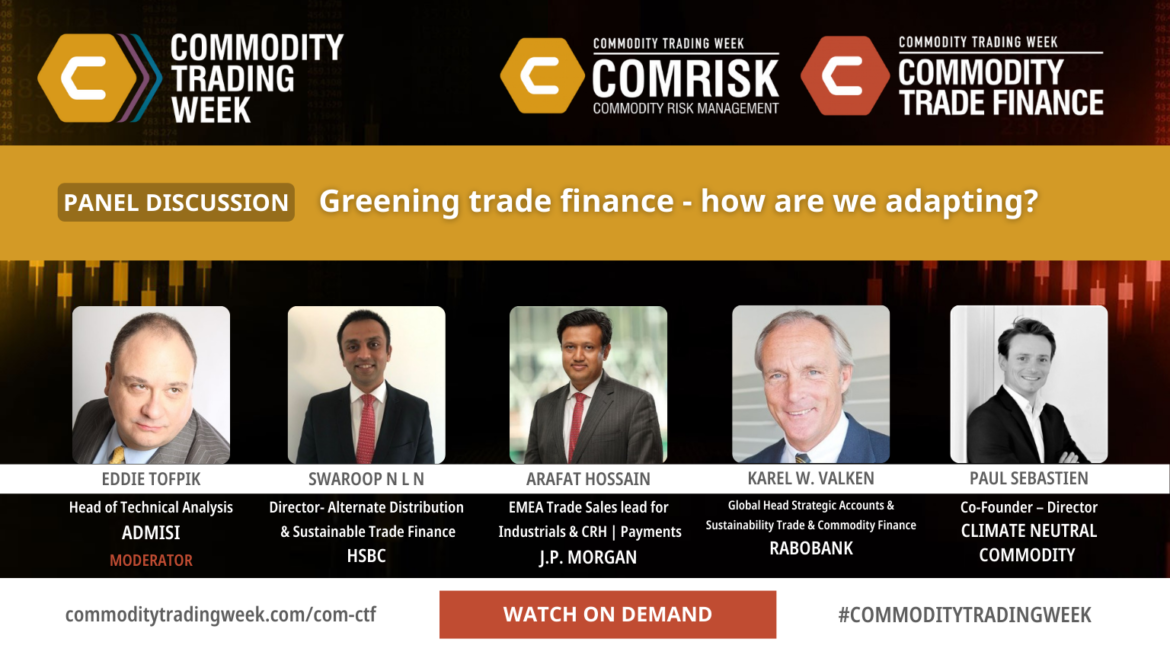

Greening Trade Finance – How Are We Adapting?

Is trade finance becoming more sustainable? ESG and green finance – what does it mean for commodity trade finance? What are the set of standards and guidelines to follow? How to structure trade finance to positively reward ESG-driven investment? How digital technology helps to drive sustainability in trade finance Risks ...

Easing Access to Trade Finance Through Digitalisation

An overview of digital tools in the market and which might be most useful for your organisationToo much or too little data? Applying analytical tools to speed up business processesUtilising AI and ML to support credit assessments – use casesElectronic documentation – what can be improved?Are these solutions interoperable? What ...

Digital Innovation in Commodity Risk: What can we expect?

PANEL: Moderator: Eddie Tofpik, Head of Technical Analysis & Senior Markets Analyst, ADM Investor Services International Ltd. Saurabh Goyal, Founder & CEO, Phlo Systems Hassan Al Alawi, Senior Advisor & Risk Professional PANEL DISCUSSION: Digitalisation in commodity trading: Where do we stand? What does it mean for risk management to ...

Data driven sustainability – A view from the business

• Why it is crucial for every type of trading company to integrate sustainability and carbon footprint in every aspect of the business? • How to handle this successfully • Carbon markets, carbon accounting, sustainability indexes • The value of carbon footprint in your daily trading operation: • Can carbon ...

Exploring future digital business models

• The role of the metaverse and transitioning from the analogue world • How far your data journey can take you and where will it end? • How trading companies can exploit quantum computing • Digital ethics… what will this mean for trading firms now and in the future?

Advancing data science in the commodity trading industry

• Integrating prescriptive analytics into your business strategy • Getting more from your data – what is existing technology capable of? • New approaches to data management and security • Machine learning, AI… more complexity?

CTRMs in exceptional times – friend or foe?

• What is expected from CTRM software in highly volatile environments and times – are they standing up to the challenge? • Cloud vs on site – exploring pros and cons • Commodity price risk management, liquidity risk and treasury tools; one system fits all? • Architectural and interoperability challenges

New Era in Commodity Trade Finance

• Sustainability, super cycles, digitalisation – Impact of key industry megatrends on commodity trade finance • What are the key investment and project execution challenges while transitioning to a net zero world and how can we mitigate them? • Speeding up with innovation- is digitisation in trade finance the great ...