Risk Management

Risk Measures for Stressed Markets

This session discusses revisiting fundamental assumptions, improving existing models with minimal effort, and suggestions for better stress testing

Bull Riding: Hedging Strategies during a High Volatility Super Cycle

This session looks at how traders are hedging their positions in a super cycle market

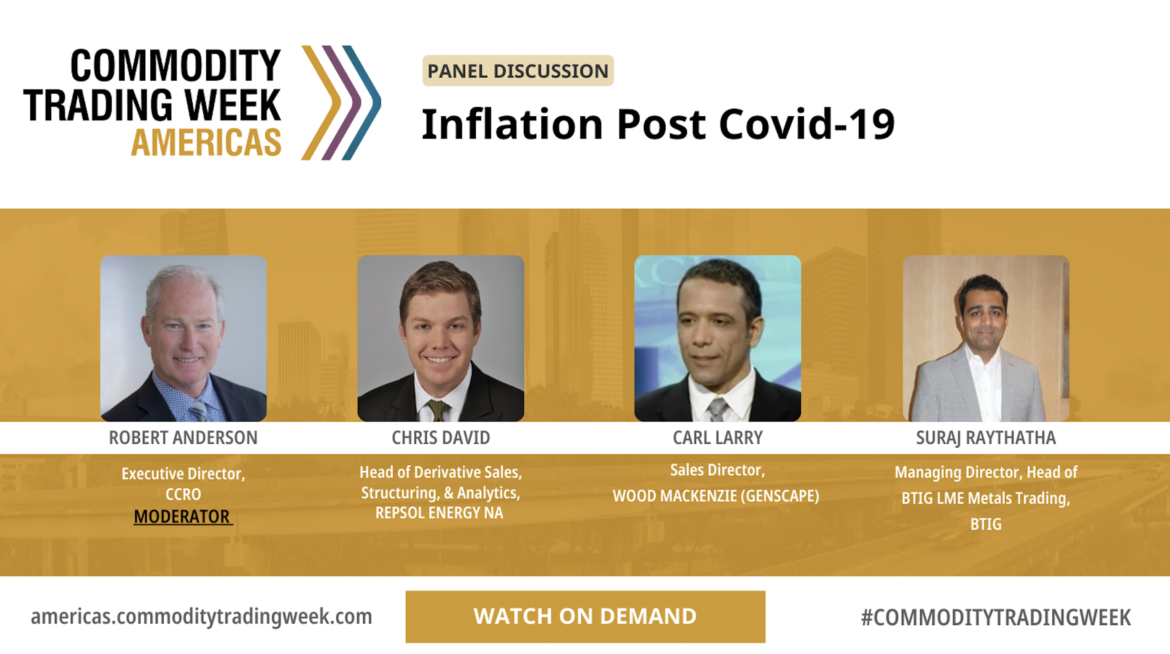

Inflation Post Covid-19

This session looks at post-pandemic blip, or a long term economic crisis, what can we expect from interest rates, and mitigation strategies

Regulatory Outlook

What are the major initiatives planned by US and EU regulatory bodies? Sanction updates in key commodity markets.

Chief Risk Officer Roundtable

Produced in association with the Committee of Chief Risk Officers (CCRO). Senior risk executives discuss the major issues on their radar, including: Volatility ESG LNG Markets Credit …and more

Navigating Volatile Freight Markets

• What is going on? What is going wrong? Is this behaviour a normal cycle event and how long will it last? • Which risk management mitigation methods and tools can be adopted in the meantime? • Best practises in utilising freight derivatives markets for hedging • From shopping trolleys ...

Committee of Chief Risk Officers (CCRO)

• Credit Risk Practices • Assuring best practices • Upgrading Your Credit Risk Strategy to Adapt to Abnormal Times • LNG and Risk Management Challenges Going Forward • Valuation; Hedging; Margin management; Risk capital • What changes could yield effective risk management? • Today’s volatility and scenario analysis as a ...

Turbulent Times Call for Advanced Risk Management: Practical Case-Study of a Food Company

• Prices of natural gas are currently at an unprecedented high. Direct costs of food companies went up but also indirect costs as fertilizer products want up as well. • How to valuate embedded hedges like accumulators • Long term risk – what can happen with your cashflow in 2023

The Great Resignation: Risk to Companies, Causes and Remedies

• Sudden or unplanned loss of labour supply – determining a back-up plan for a catastrophic loss of labour supply • Identifying labour risk – working with HR and other business units to pre emptively secure your workforce • The WFH era… How do you manage risks in the global, ...