Videos

Using Technology to Create a Culture of Trading Compliance

Developing a mix of trading technologies (CTRM, Trade Surveillance, Machine Learning, RPA) to ensure regulatory compliance? How do these technologies fit into an ESG strategy in regard to corporate governance?

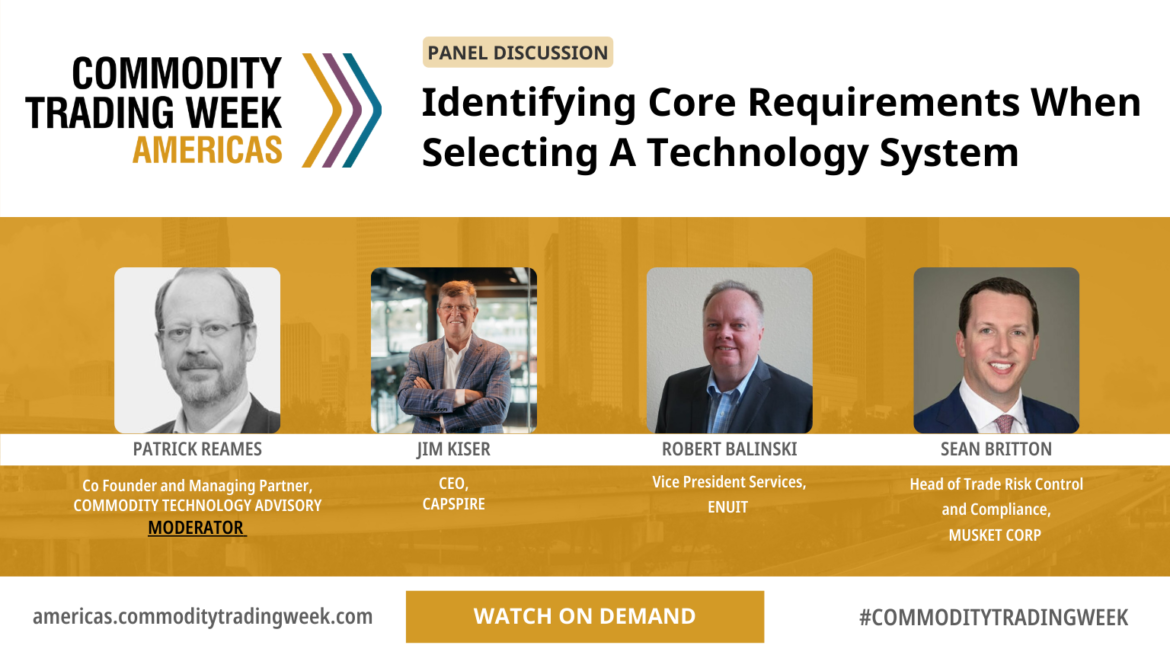

Identifying Core Requirements When Selecting a Technology System

Establishing priorities, from financial considerations to functionality, useability and scalability. Pros and cons of cookie cutter versus tailored solutions. Working with key stakeholders to prioritize system requirements. Impact of regulatory developments on decision making

Risk in the Maritime Supply Chain

Risk is personal! Perceived risk and reputational impact. Sustainability and Risk. Due diligence and governance. Transactional risk in the maritime domain. Adapting to pace of change. Maritime supply chain risks

Regulatory Outlook

What are the major initiatives planned by US and EU regulatory bodies? Sanction updates in key commodity markets.

Chief Risk Officer Roundtable

Produced in association with the Committee of Chief Risk Officers (CCRO). Senior risk executives discuss the major issues on their radar, including: Volatility ESG LNG Markets Credit …and more

Metals moving markets

Overview and pricing forecast for base metals

A Golden Era of Fraud and Financial Crime in Commodity Trade?

• Why has the pandemic been an enabler to increased fraud and risk? • Cyber defence – what does the CTF community need to know and do? • Lessons learned from recent high profile cases • Where can new technologies play a role in mitigating these risks?

Sustainable Trade Finance – The Road Ahead

• Evolution not revolution? Adapting traditional trade mechanisms whilst driving change • Demonstrating best practice in climate transparency and calculation of carbon footprints • A look into sustainability linked loans – what is available and what products/structures are likely to emerge? • What are the opportunities of climate finance in ...

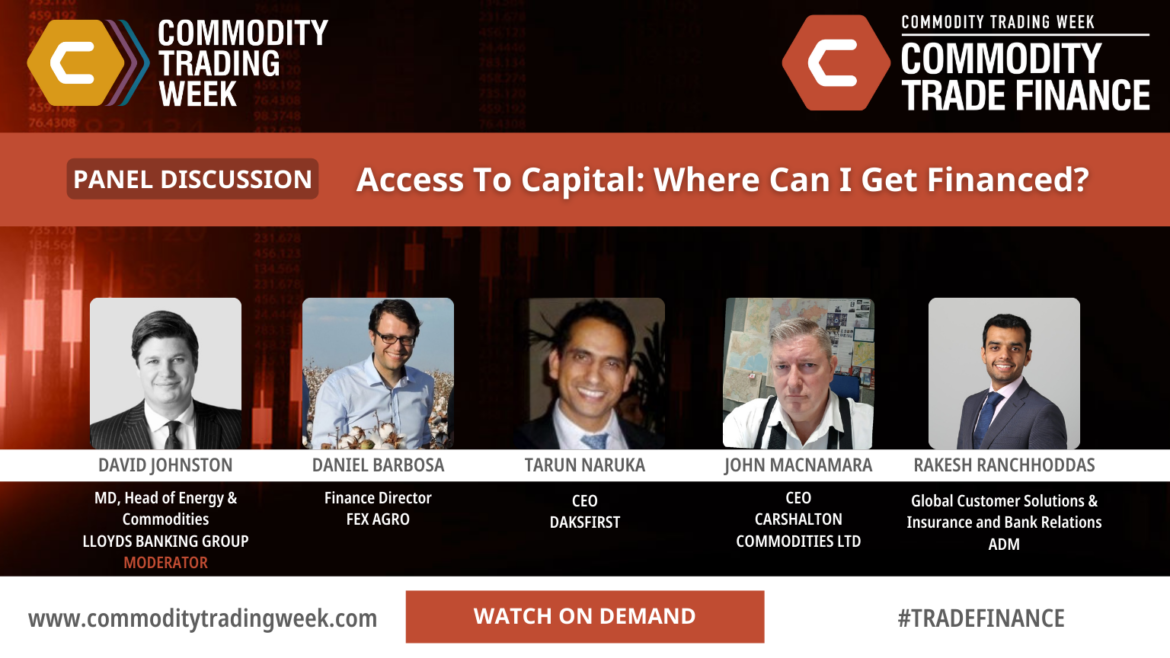

Access to Capital: Where Can I Get Financed?

• How have events in Ukraine impacted the global market for commodity trade finance? • Should investors & lenders fear the ‘structured LC’ or are they an important part of the mix, if done ‘correctly’? • Is traditional financing still feasible for SMEs? What alternative finance mechanisms/ routes are available? ...