Videos

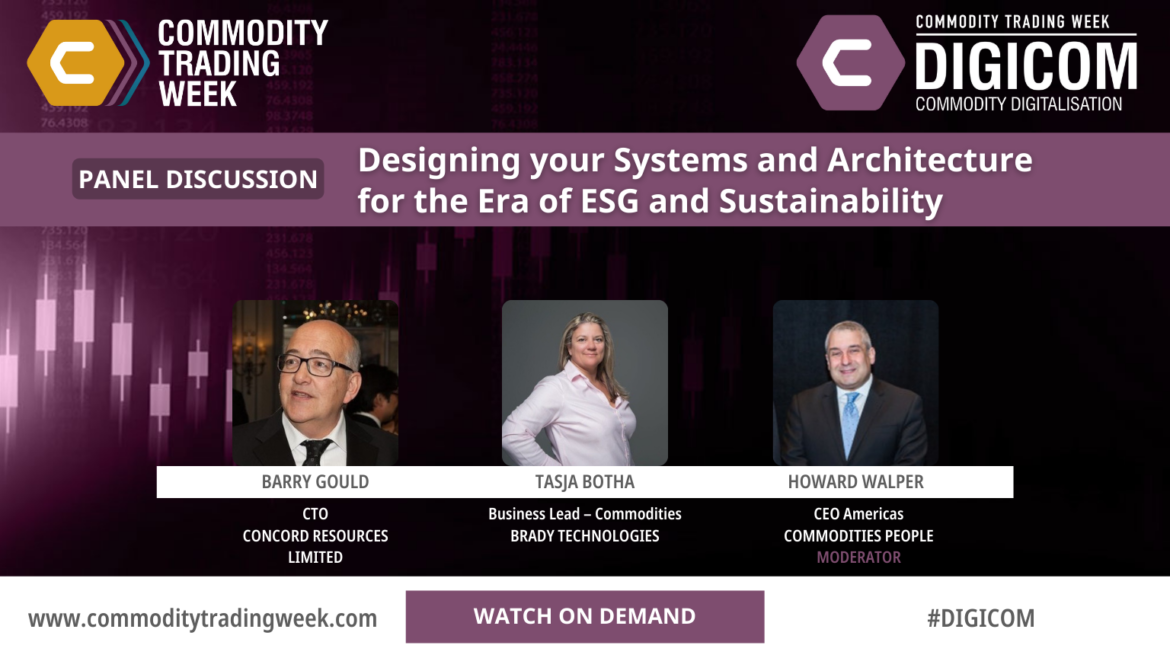

Designing Your Systems and Architecture for the Era of ESG and Sustainability

• Designing technology infrastructures to enable concise ESG reporting and progress in (as close to) real time • ESG and Carbon footprint: The need for benchmarks • Are my existing CTRM and other systems ESG ready? • ESG market and transactional data sourcing and management

Transitioning Into a (Genuinely) Data-driven Organisation

• How do you define a data driven company? • What is the architecture behind it? • What is the data culture? What skills are needed to drive data strategy? • A deeper look into standards, platforms and processes• What can commodity trading learn from other industries?

Regulatory Impact – What Might the Future Regulatory Landscape for Commodity Trading Look Like?

• How did we get here? The state of financial style regulation• The current situation – Key themes in the current “crisis”• What could the future bring?

Committee of Chief Risk Officers (CCRO)

• Credit Risk Practices • Assuring best practices • Upgrading Your Credit Risk Strategy to Adapt to Abnormal Times • LNG and Risk Management Challenges Going Forward • Valuation; Hedging; Margin management; Risk capital • What changes could yield effective risk management? • Today’s volatility and scenario analysis as a ...

Turbulent Times Call for Advanced Risk Management: Practical Case-Study of a Food Company

• Prices of natural gas are currently at an unprecedented high. Direct costs of food companies went up but also indirect costs as fertilizer products want up as well. • How to valuate embedded hedges like accumulators • Long term risk – what can happen with your cashflow in 2023

The Great Resignation: Risk to Companies, Causes and Remedies

• Sudden or unplanned loss of labour supply – determining a back-up plan for a catastrophic loss of labour supply • Identifying labour risk – working with HR and other business units to pre emptively secure your workforce • The WFH era… How do you manage risks in the global, ...

Supply Chain Risk in the Spotlight

• Managing risk in volatile freight and shipping markets • Fraud mitigation strategies • What will be the impact of increasingly localised supply chains? • Examining best practises and structures for working with multi-regional operations teams

CTRM’s: What’s Going Right? What’s Going Wrong? The Risk Leaders’ Viewpoint

• Rethinking CTRM technology, features and approach: What are the essentials from a risk management perspective? • Ecosystems vs “one size fit all” • Is your system an inhibitor, or an enabler, of your risk department digital transformation?

Agility in Risk Reporting, a must-have asset to cope with uncertain times

When global flows get disrupted, commodity companies scramble for insights into their operational exposures. Backed with real-world examples, this case study will first explore how multi-dimensional reporting enables companies to better navigate uncertainty. In the second part, it will demonstrate how a comprehensive and flexible data model is the key ...