Carbon Footprint

Dycotrade: Commodity Trading Market Trends and Outlooks

Sustainability in commodity trading is crucial, focusing on ethical sourcing and reducing carbon footprints. Digital transformation, like blockchain, enhances efficiency, while geopolitical tensions and renewable energy transitions significantly impact the market.

Data driven sustainability – A view from the business

• Why it is crucial for every type of trading company to integrate sustainability and carbon footprint in every aspect of the business? • How to handle this successfully • Carbon markets, carbon accounting, sustainability indexes • The value of carbon footprint in your daily trading operation: • Can carbon ...

Greener Dollars: Sustainable Finance

How are lenders viewing ESG ratings and trade specific carbon footprints? Evolution not revolution? Adapting traditional trade mechanisms whilst driving change. Demonstrating best practice in climate transparency and calculation of carbon footprints. What are the opportunities of climate finance in emerging markets?

Sustainable Trade Finance – The Road Ahead

• Evolution not revolution? Adapting traditional trade mechanisms whilst driving change • Demonstrating best practice in climate transparency and calculation of carbon footprints • A look into sustainability linked loans – what is available and what products/structures are likely to emerge? • What are the opportunities of climate finance in ...

Trading the Transition – Maximising Opportunities in Carbon and Other ESG Linked Markets

• An overview of the global carbon markets of greatest interest, how to access and their outlooks • Development of global methane offset markets; implications for agri-traders • Hydrogen markets – what will the opportunities be? • What are the secondary trading opportunities developing from the transition? Examining the markets ...

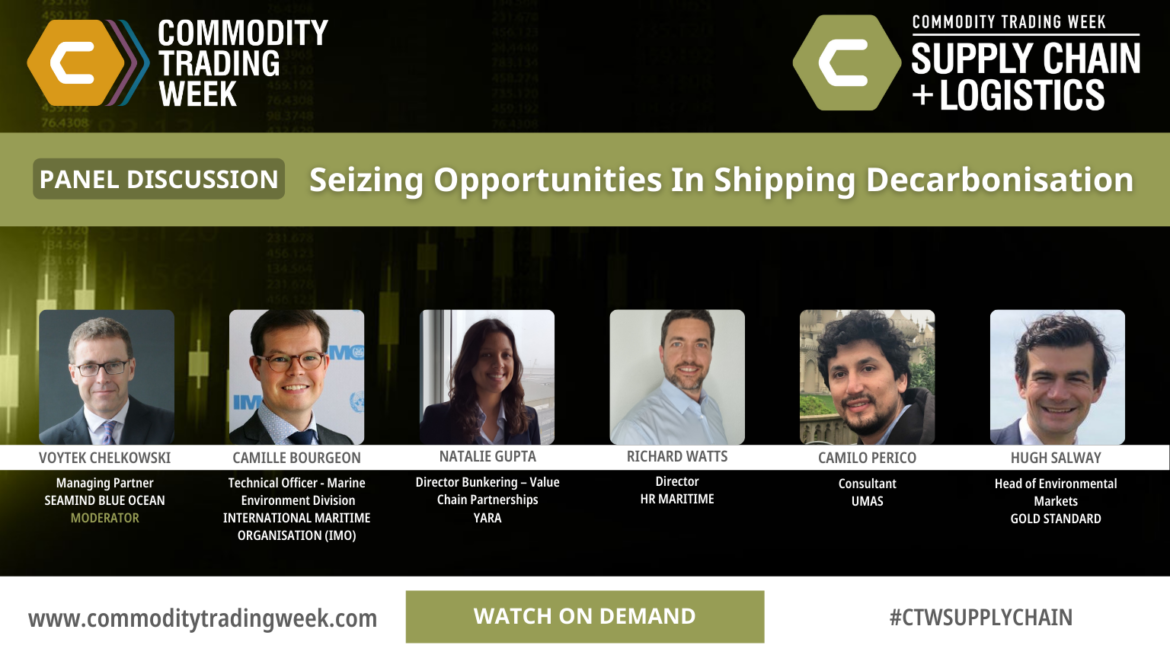

Seizing Opportunities in Shipping Decarbonisation

• IMO’s plans for ensuring transparency and accountability for decarbonisation in the shipping sector • Overview of latest regulations & other standards to control shipping emissions – what do we see emerging in the years ahead? • An overview of new digital initiatives: Which of these are most credible? • ...

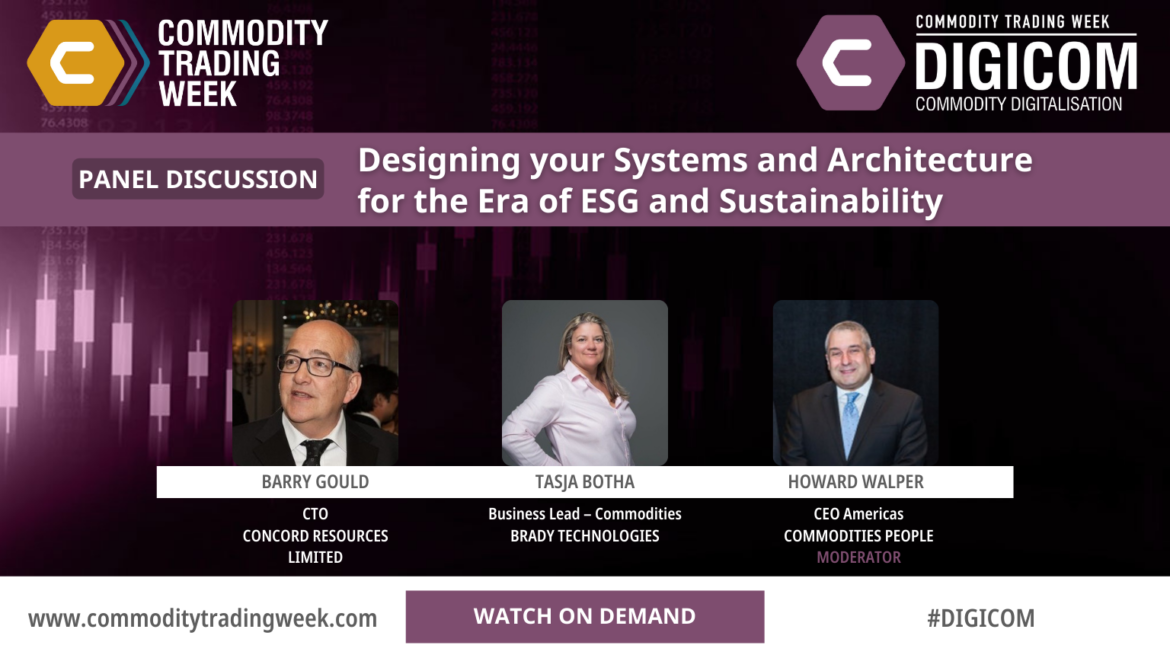

Designing Your Systems and Architecture for the Era of ESG and Sustainability

• Designing technology infrastructures to enable concise ESG reporting and progress in (as close to) real time • ESG and Carbon footprint: The need for benchmarks • Are my existing CTRM and other systems ESG ready? • ESG market and transactional data sourcing and management

ESG and Climate Change – the Risk Managers Perspective

• Climate risk scenario modelling • Managing exposure to carbon and other environmental markets • Greenwasher! And other reputational risks to consider • Calculating your carbon footprint and understanding your climate credit rating • Sustainable financing: staying ahead of the curve

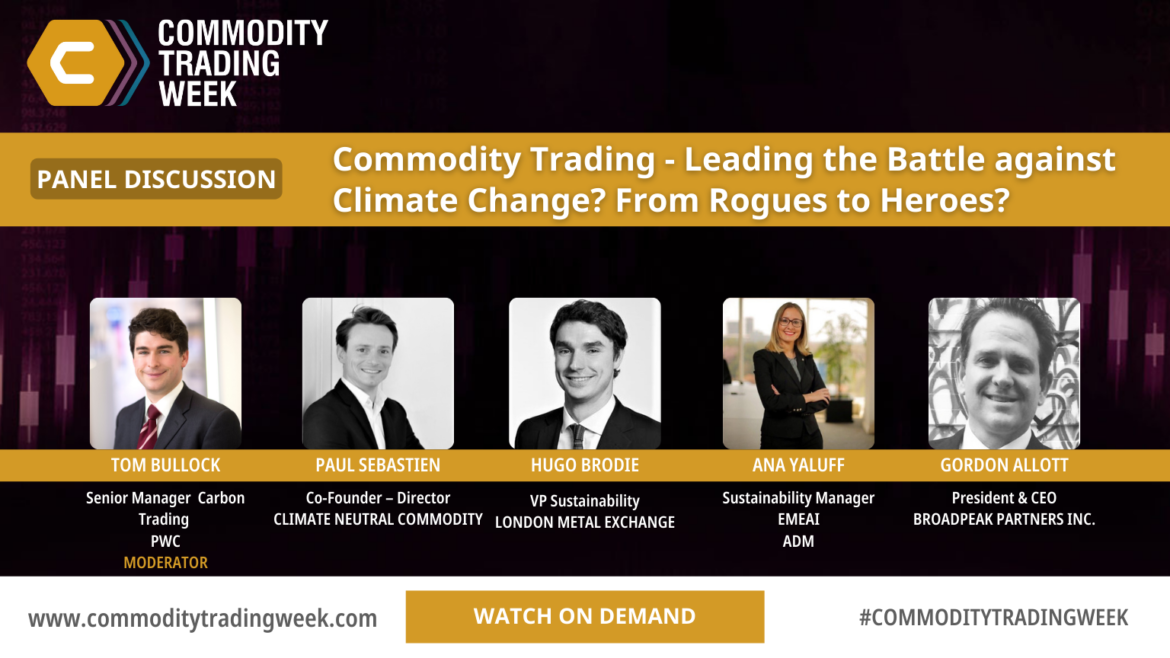

Commodity Trading – Leading the Battle Against Climate Change? From Rogues to Heroes?

• Development of ‘green’ commodity markets: drivers, perspectives • The role to play for the commodity industry to support the emergence of low carbon markets • Environmental/carbon neutral claims: standardisation, verification, transparency for credible claims • Life cycle carbon footprint calculation, reporting: complexity, good/best practices, industry standards