Climate change

New Year, New Risks: What risks are “top of mind” for risk practitioners in 2024 – Commodity Risk & Finance 2024

Discover how high interest rates, inflation, recession risks, geopolitics, regulatory changes, and climate shifts are reshaping market dynamics, with insights from Brock Mosovsky, Eric Twombly, and others

Greener Dollars: Sustainable Finance

How are lenders viewing ESG ratings and trade specific carbon footprints? Evolution not revolution? Adapting traditional trade mechanisms whilst driving change. Demonstrating best practice in climate transparency and calculation of carbon footprints. What are the opportunities of climate finance in emerging markets?

A Brief Update on the SEC Rule-Making on Climate Disclosures & What This Means for Trading Companies

This session gives a brief update on the SEC rule-making on climate disclosures & what this means for trading companies

Executive Roundtable

This session looks at the impact of sustainability initiatives on commodity trading companies, combating image issues in an increasingly climate-focused world, impact of sustainability initiatives on investment, and ESG from a leadership perspective/creating a culture of sustainability trading

Sustainable Trade Finance – The Road Ahead

• Evolution not revolution? Adapting traditional trade mechanisms whilst driving change • Demonstrating best practice in climate transparency and calculation of carbon footprints • A look into sustainability linked loans – what is available and what products/structures are likely to emerge? • What are the opportunities of climate finance in ...

“To Infinity… And Beyond!” Developing Your Satellite Strategy

• Mini case studies: How are trading firms presently utilising satellite technology? • Supply chain/logistics • Crop yield real time analysis • Mine productivity • Storage • Integrating with AI and Machine learning • Satellite data’s role in the fight against climate change • Develop in house, or buy off ...

KPMG’s Climate IQ Solution

James will introduce KPMG’s Climate IQ solution which is used by global enterprises to model the impact of climate change scenarios at asset level over a 30 year horizon, allowing firms not only to meet their climate change impact disclosure obligations, but also to take informed decisions with respect to ...

ESG and Climate Change – the Risk Managers Perspective

• Climate risk scenario modelling • Managing exposure to carbon and other environmental markets • Greenwasher! And other reputational risks to consider • Calculating your carbon footprint and understanding your climate credit rating • Sustainable financing: staying ahead of the curve

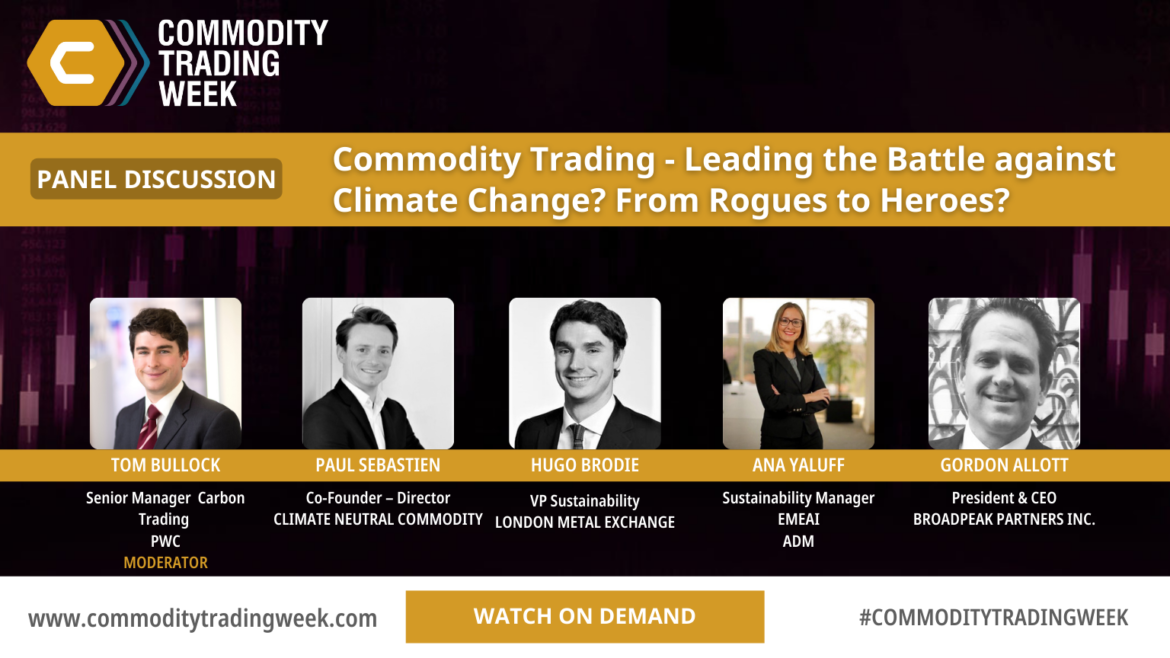

Commodity Trading – Leading the Battle Against Climate Change? From Rogues to Heroes?

• Development of ‘green’ commodity markets: drivers, perspectives • The role to play for the commodity industry to support the emergence of low carbon markets • Environmental/carbon neutral claims: standardisation, verification, transparency for credible claims • Life cycle carbon footprint calculation, reporting: complexity, good/best practices, industry standards