CTW22

Commodity Trading Annual Industry Survey 2022

We cooperated with some of the industry’s leading commentators to provide analysis, and bring data to life on Commodities Trading.

A Golden Era of Fraud and Financial Crime in Commodity Trade?

• Why has the pandemic been an enabler to increased fraud and risk? • Cyber defence – what does the CTF community need to know and do? • Lessons learned from recent high profile cases • Where can new technologies play a role in mitigating these risks?

Sustainable Trade Finance – The Road Ahead

• Evolution not revolution? Adapting traditional trade mechanisms whilst driving change • Demonstrating best practice in climate transparency and calculation of carbon footprints • A look into sustainability linked loans – what is available and what products/structures are likely to emerge? • What are the opportunities of climate finance in ...

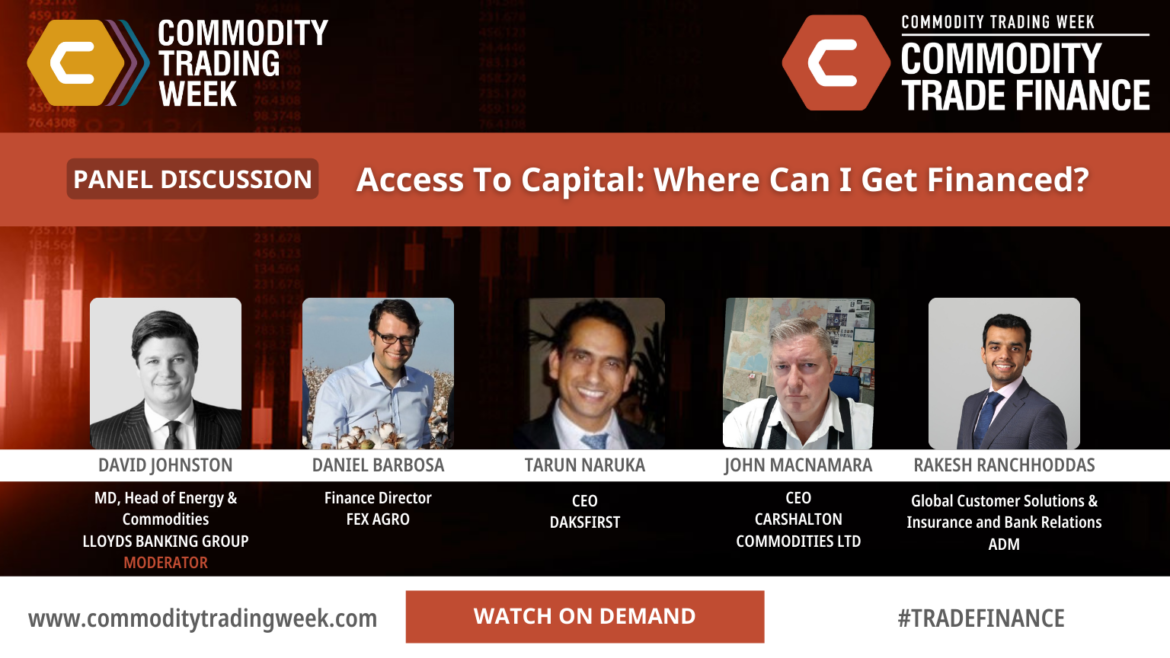

Access to Capital: Where Can I Get Financed?

• How have events in Ukraine impacted the global market for commodity trade finance? • Should investors & lenders fear the ‘structured LC’ or are they an important part of the mix, if done ‘correctly’? • Is traditional financing still feasible for SMEs? What alternative finance mechanisms/ routes are available? ...

Where Next for Digital Innovation in Commodity Trade Finance?

• An overview of notable CTF FinTech on the market today • Evolution or revolution? What is truly most important to the traders and financiers? • Addressing the challenge of digital islands – how can interoperability be enhanced between trade finance tech providers? • Does blockchain have a role? What ...

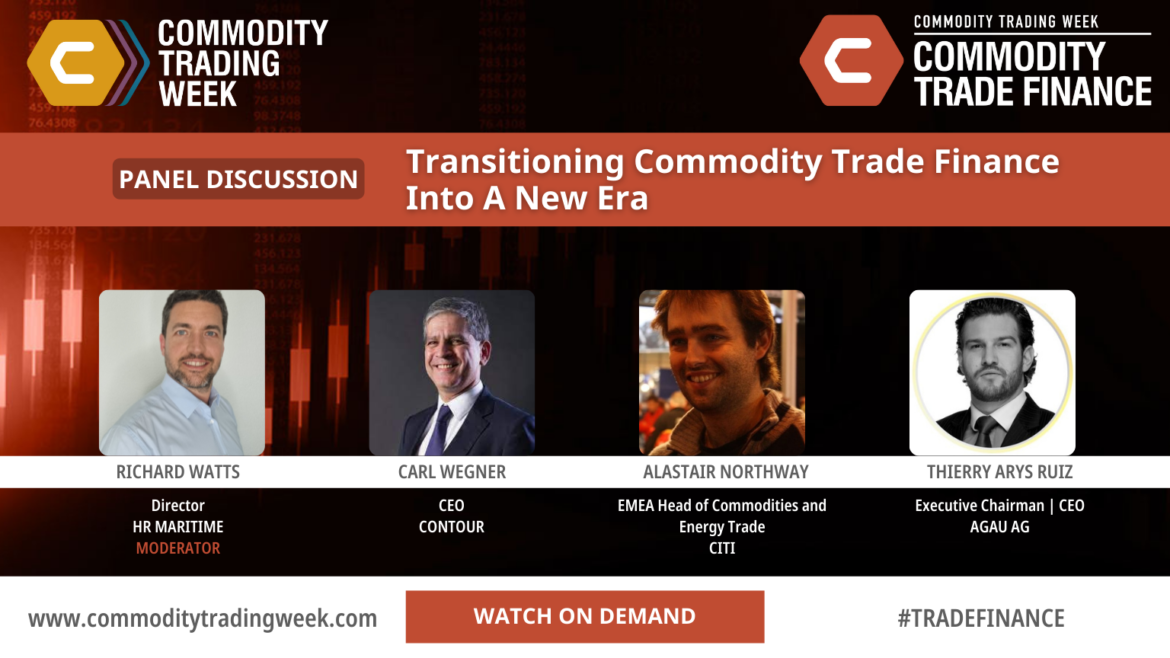

Transitioning Commodity Trade Finance Into a New Era

• Sustainability, supercycles, digitalisation – Impact of key industry megatrends on CTF • What are the key investment and project execution challenges while transitioning to a net zero world and how can we mitigate? • Buckle your seatbelts? The short, medium and long term impacts of the supercycle on financing ...

Financialisation in the Commodity Markets

• There will be a growth in “Outsiders” trading commodity markets, who are primarily treating commodities purely as a financial asset • This will be driven by trends in inflation and asset correlations • This will change the structure of the market. Some of those changes can be predicted.

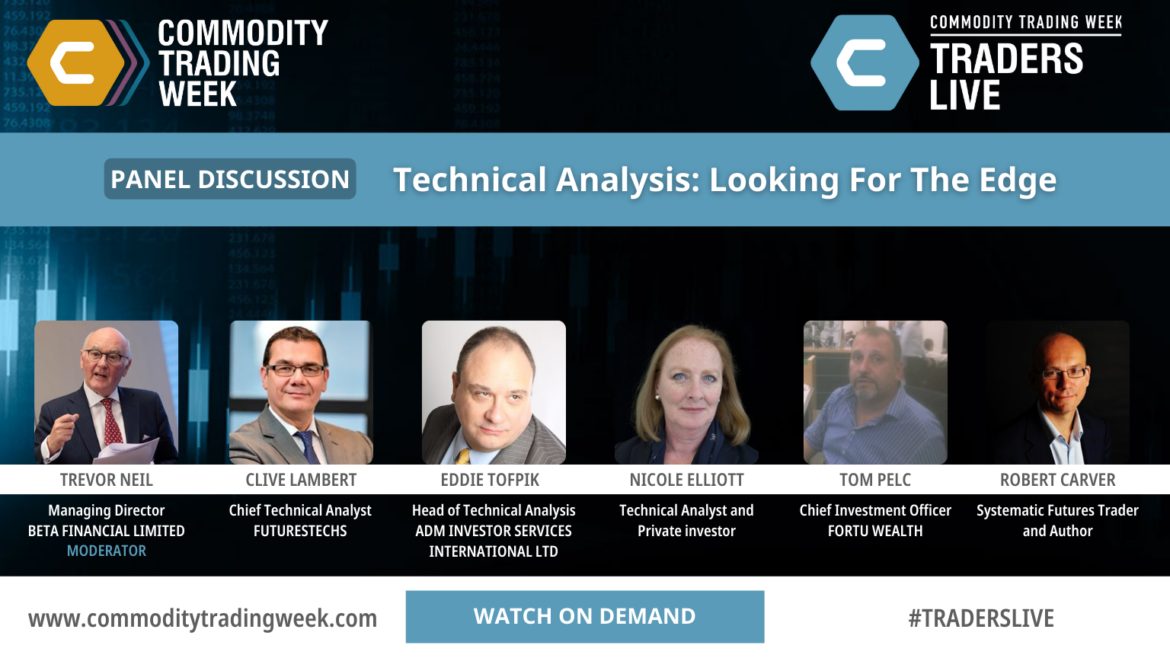

Technical Analysis: Looking for the Edge

• With the increased use of Algo trading, is technical analysis still relevant? • Is liquidity too low in commodity markets for technical analysis to be efficient? Does it work enough so that it MUST be used? • Top technical analysts comment on your markets – The panellists want your ...

Trading the Transition – Maximising Opportunities in Carbon and Other ESG Linked Markets

• An overview of the global carbon markets of greatest interest, how to access and their outlooks • Development of global methane offset markets; implications for agri-traders • Hydrogen markets – what will the opportunities be? • What are the secondary trading opportunities developing from the transition? Examining the markets ...