CTW22

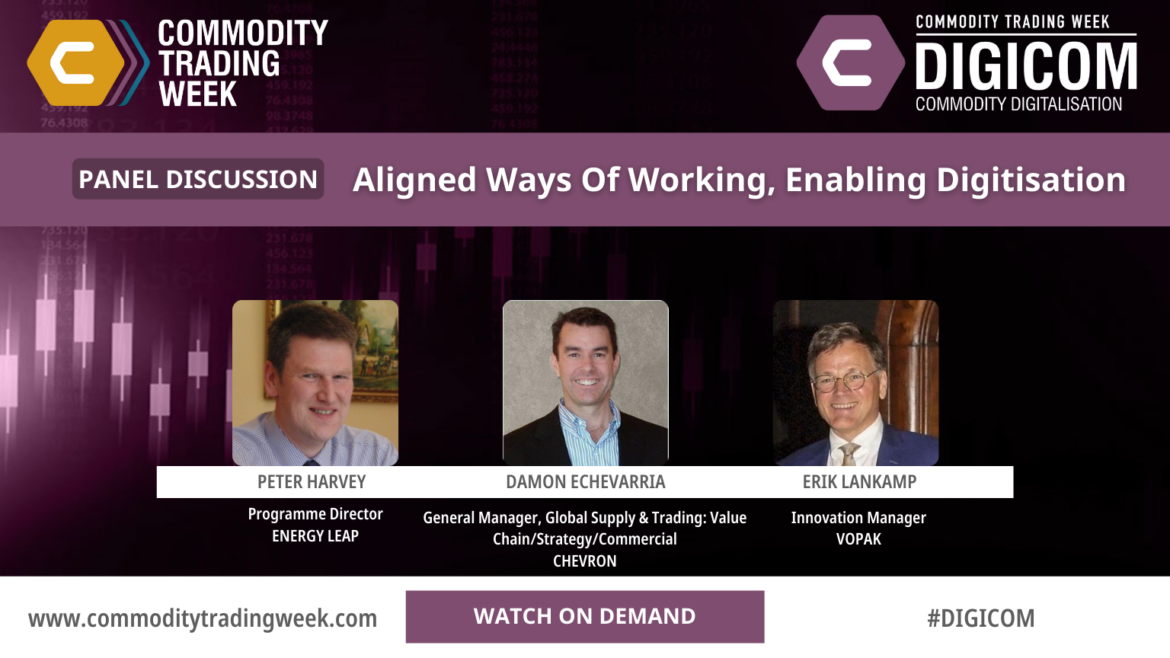

Aligned Ways of Working, enabling Digitisation

• Driving a step-change in efficiencies for oil trading and associated operations • Having a safe environment for cross industry collaboration • How standard contracts, and data definitions can unlock value

Decentralisation and Democratisation of the IT Department: Empowering Business Users

• Exploring experiences so far in developing a “self-service” modelAssessing the potential benefits :• Broadening access to often underused functionalities • Ensuring technology is less of a bottleneck • Better use and understanding of data, creating the right data catalogues and data architecture • Reducing the dependence of tech teams ...

Developing Your CTRM Strategy – Keeping Up With the Rapid Pace of Change

• How can your CTRMs support analytics and architectures? • Troubleshooting and problem solving in CTRM projects – real-life examples and practical takeaways • Man vs machine? Ensuring your CTRM support team is robust, correctly skilled, resourced and individuals are not irreplaceable • Build vs Buy – the old debate ...

Driving Interoperability Through Next Generation Architecture Strategy and Design

• Architecture: from an enterprise data warehouse to data mesh concept. • Can you enable a data driven organisation with legacy systems? • Is the era of an end to end ERP gone? Or is it simply evolving? • Ensuring a solid integration layer – the key to success in ...

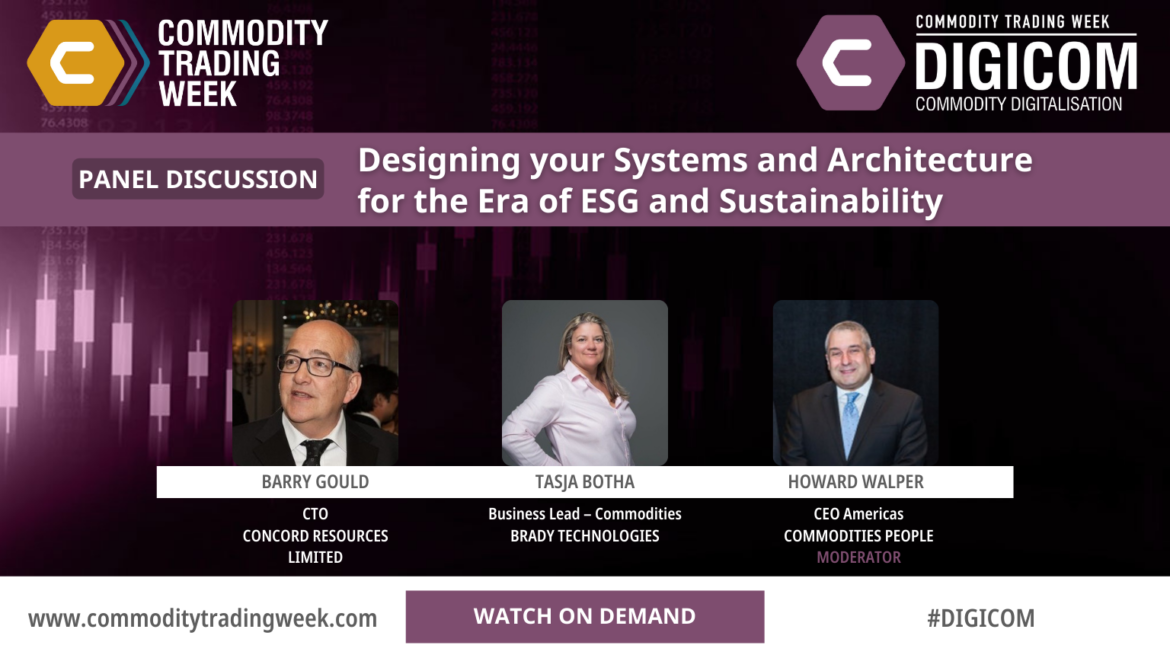

Designing Your Systems and Architecture for the Era of ESG and Sustainability

• Designing technology infrastructures to enable concise ESG reporting and progress in (as close to) real time • ESG and Carbon footprint: The need for benchmarks • Are my existing CTRM and other systems ESG ready? • ESG market and transactional data sourcing and management

Transitioning Into a (Genuinely) Data-driven Organisation

• How do you define a data driven company? • What is the architecture behind it? • What is the data culture? What skills are needed to drive data strategy? • A deeper look into standards, platforms and processes• What can commodity trading learn from other industries?

Regulatory Impact – What Might the Future Regulatory Landscape for Commodity Trading Look Like?

• How did we get here? The state of financial style regulation• The current situation – Key themes in the current “crisis”• What could the future bring?

Committee of Chief Risk Officers (CCRO)

• Credit Risk Practices • Assuring best practices • Upgrading Your Credit Risk Strategy to Adapt to Abnormal Times • LNG and Risk Management Challenges Going Forward • Valuation; Hedging; Margin management; Risk capital • What changes could yield effective risk management? • Today’s volatility and scenario analysis as a ...

Turbulent Times Call for Advanced Risk Management: Practical Case-Study of a Food Company

• Prices of natural gas are currently at an unprecedented high. Direct costs of food companies went up but also indirect costs as fertilizer products want up as well. • How to valuate embedded hedges like accumulators • Long term risk – what can happen with your cashflow in 2023