CTWA22

A Brief Update on the SEC Rule-Making on Climate Disclosures & What This Means for Trading Companies

This session gives a brief update on the SEC rule-making on climate disclosures & what this means for trading companies

Executive Roundtable

This session looks at the impact of sustainability initiatives on commodity trading companies, combating image issues in an increasingly climate-focused world, impact of sustainability initiatives on investment, and ESG from a leadership perspective/creating a culture of sustainability trading

Bull Riding: Hedging Strategies during a High Volatility Super Cycle

This session looks at how traders are hedging their positions in a super cycle market

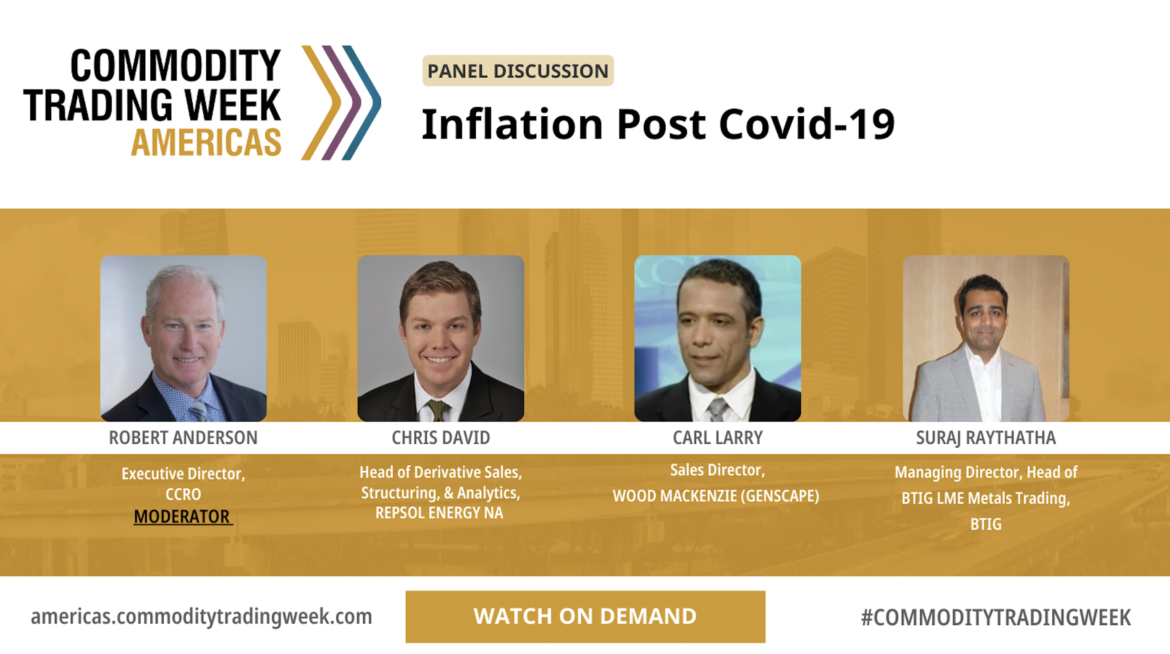

Inflation Post Covid-19

This session looks at post-pandemic blip, or a long term economic crisis, what can we expect from interest rates, and mitigation strategies

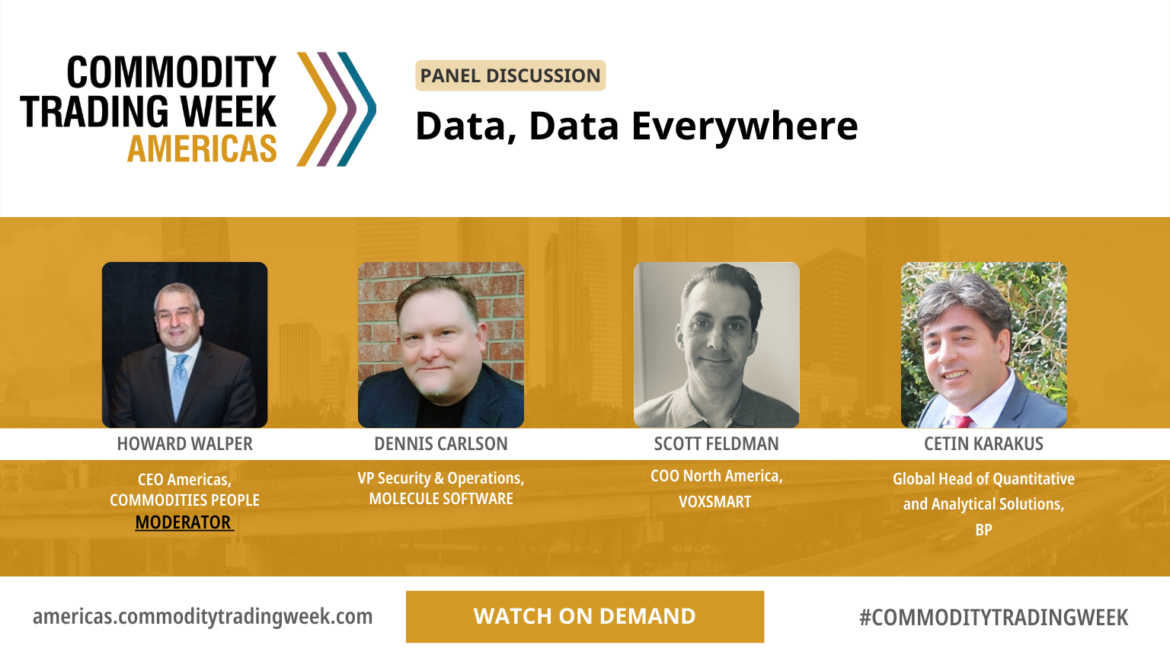

Data, Data Everywhere

Trends and impacts of data and digitalization. An overview of data tools and landscape from ingestion to advanced analytics. Developing a framework to manage data and ensure data governance: ensuring data integrity and transparency. Leveraging data analytics to make decisions across domains.

Digitalization of Trade Finance

Growth of CTF FinTech and what we are seeing today. Evolution or revolution? What is truly most important to the traders and financiers? Impact on risk and capital treatment. High commodity prices, price volatility, liquidity…. How can the commodity finance industry can pro actively manage during these challenging times. Can ...

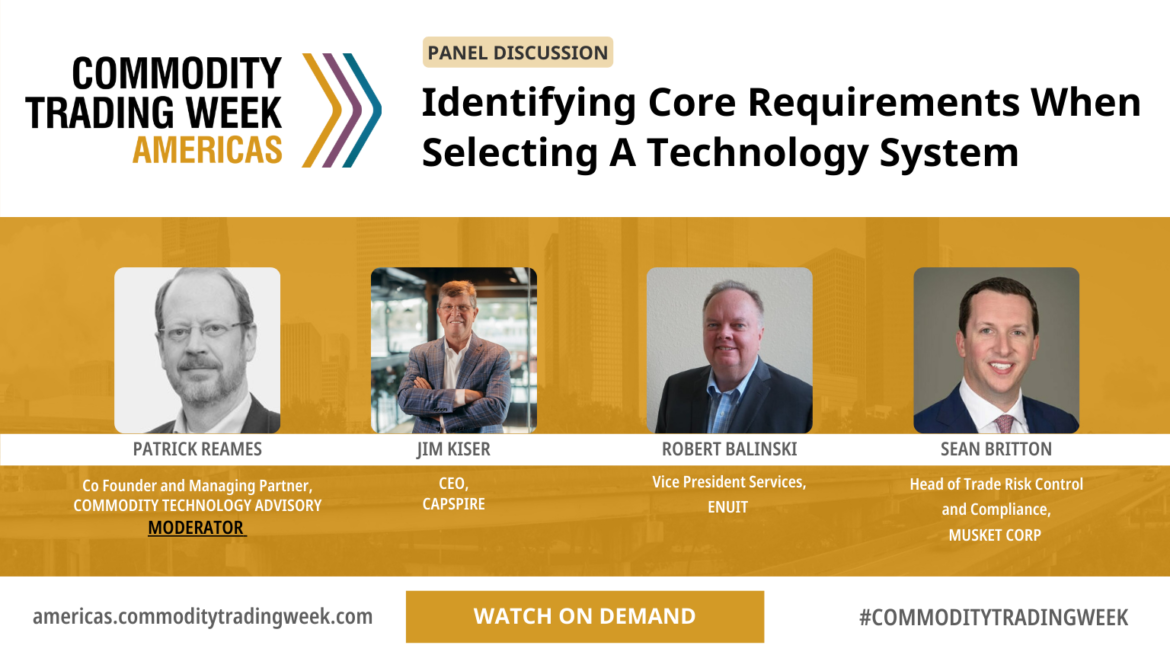

Identifying Core Requirements When Selecting a Technology System

Establishing priorities, from financial considerations to functionality, useability and scalability. Pros and cons of cookie cutter versus tailored solutions. Working with key stakeholders to prioritize system requirements. Impact of regulatory developments on decision making

Risk in the Maritime Supply Chain

Risk is personal! Perceived risk and reputational impact. Sustainability and Risk. Due diligence and governance. Transactional risk in the maritime domain. Adapting to pace of change. Maritime supply chain risks

Regulatory Outlook

What are the major initiatives planned by US and EU regulatory bodies? Sanction updates in key commodity markets.