ESG

Impact of ESG on the Trade Life Cycle

This session looks at the industry view of ESG, essential or “greenwashing”? ESG metrics and benchmarks, and efforts towards industry standardization

Executive Roundtable

This session looks at the impact of sustainability initiatives on commodity trading companies, combating image issues in an increasingly climate-focused world, impact of sustainability initiatives on investment, and ESG from a leadership perspective/creating a culture of sustainability trading

Using Technology to Create a Culture of Trading Compliance

Developing a mix of trading technologies (CTRM, Trade Surveillance, Machine Learning, RPA) to ensure regulatory compliance? How do these technologies fit into an ESG strategy in regard to corporate governance?

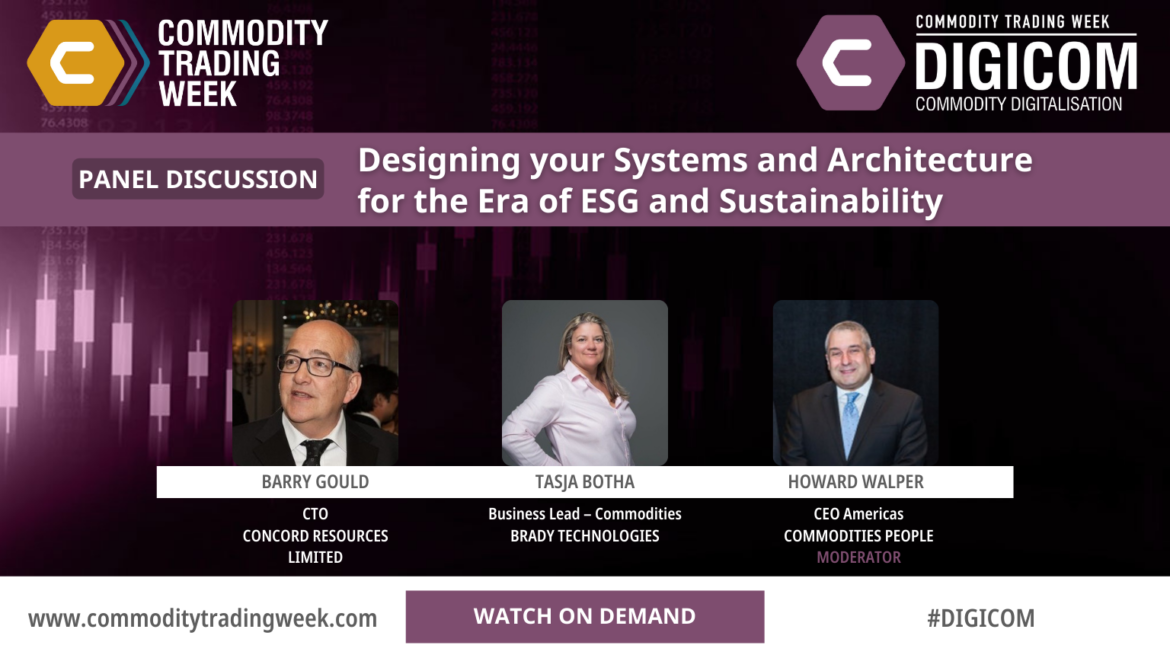

Designing Your Systems and Architecture for the Era of ESG and Sustainability

• Designing technology infrastructures to enable concise ESG reporting and progress in (as close to) real time • ESG and Carbon footprint: The need for benchmarks • Are my existing CTRM and other systems ESG ready? • ESG market and transactional data sourcing and management

How Legal Teams Adapt to the Transformative ESG Trends

• The impact of the changing geo-political landscapes in legal teams. • Advising in a changing sanctions environment. • Keeping ESG principals and targets in a crisis environment.

ESG and Climate Change – the Risk Managers Perspective

• Climate risk scenario modelling • Managing exposure to carbon and other environmental markets • Greenwasher! And other reputational risks to consider • Calculating your carbon footprint and understanding your climate credit rating • Sustainable financing: staying ahead of the curve

Driving the Transition through ESG Finance

• What are the carrots, and what are the sticks that traders can expect from the financial sector in the years ahead? • Integrating ESG into banking frameworks – realistic rates of change • What are the key drivers of change in the financial landscape? • Emerging products and structures ...

ESG CRITERIA AND TRADE FINANCE – HOW THESE CHANGES WILL AFFECT YOUR ABILITY TO GET FINANCED?

• Defining a truly data driven company: what is the architecture behind it? • Fostering Data culture in your organisation- what is important and What skills are needed to drive data strategy? • A deeper look into standards, platforms and processes • What can commodity trading learn from other industries?