Finance

Impact of Extreme Volatility on Large Trading Companies

How are company leaders positioning themselves in an era of high prices and extreme volatility? How has the war on Ukraine impacted different markets? How will this impact markets in the long term? What are the lingering impacts of COVID-19? Are supply chains springing back, and if not, how long ...

Greener Dollars: Sustainable Finance

How are lenders viewing ESG ratings and trade specific carbon footprints? Evolution not revolution? Adapting traditional trade mechanisms whilst driving change. Demonstrating best practice in climate transparency and calculation of carbon footprints. What are the opportunities of climate finance in emerging markets?

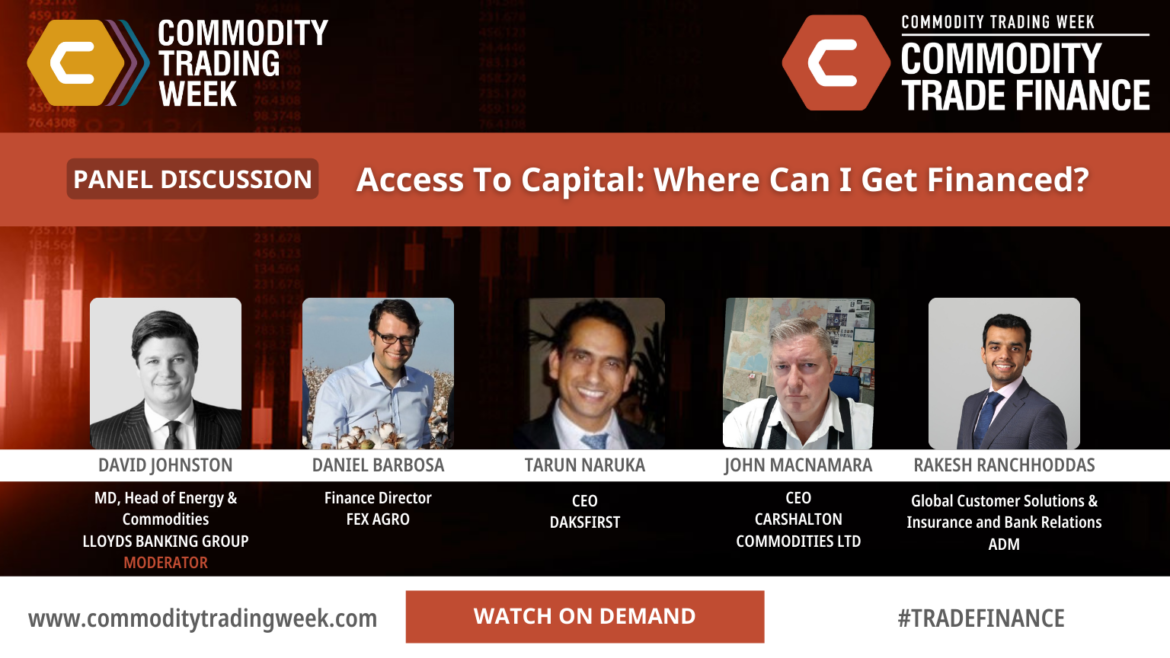

Access to Capital: Where Can I Get Financed?

• How have events in Ukraine impacted the global market for commodity trade finance? • Should investors & lenders fear the ‘structured LC’ or are they an important part of the mix, if done ‘correctly’? • Is traditional financing still feasible for SMEs? What alternative finance mechanisms/ routes are available? ...

Financialisation in the Commodity Markets

• There will be a growth in “Outsiders” trading commodity markets, who are primarily treating commodities purely as a financial asset • This will be driven by trends in inflation and asset correlations • This will change the structure of the market. Some of those changes can be predicted.

Regulatory Impact – What Might the Future Regulatory Landscape for Commodity Trading Look Like?

• How did we get here? The state of financial style regulation• The current situation – Key themes in the current “crisis”• What could the future bring?

BLOCKCHAIN IN COMMODITIES – IS NOW THE TIME?

• Defining a truly data driven company: what is the architecture behind it? • Fostering Data culture in your organisation- what is important and What skills are needed to drive data strategy? • A deeper look into standards, platforms and processes • What can commodity trading learn from other industries?