Risk

Advances in Risk Technology – Commodity Risk & Finance 2024

Explore how CTRM/ETRM systems adapt to modern traders’ needs, AI’s role in risk assessment, and the evolution of data management and security with top industry experts.

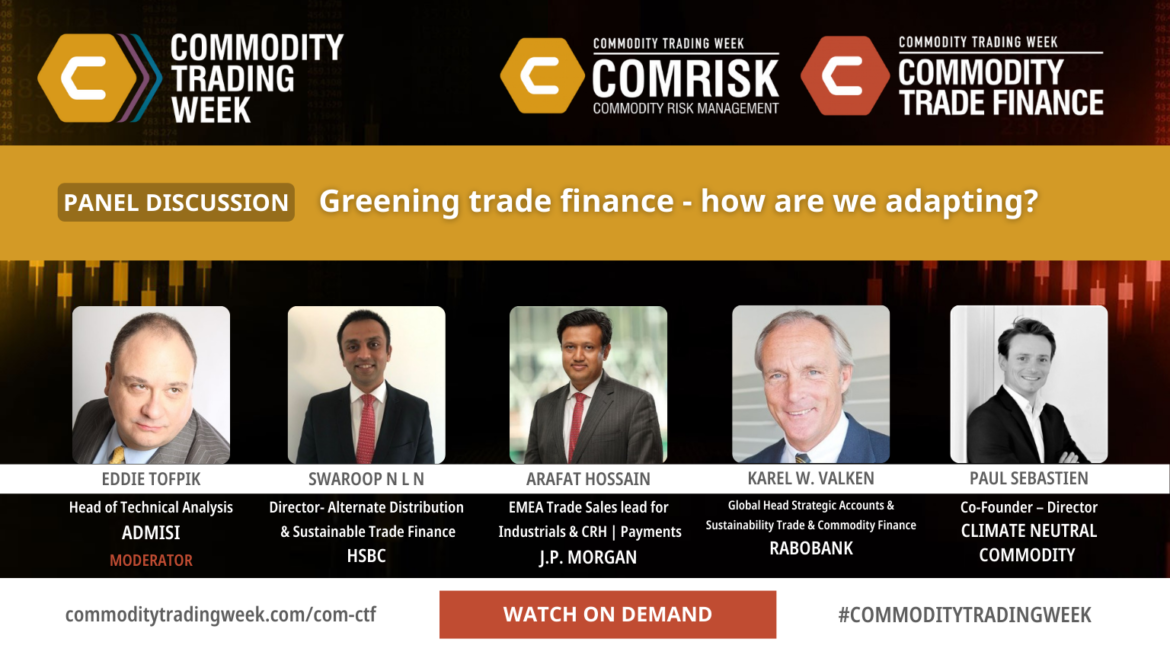

Greening Trade Finance – How Are We Adapting?

Is trade finance becoming more sustainable? ESG and green finance – what does it mean for commodity trade finance? What are the set of standards and guidelines to follow? How to structure trade finance to positively reward ESG-driven investment? How digital technology helps to drive sustainability in trade finance Risks ...

Easing Access to Trade Finance Through Digitalisation

An overview of digital tools in the market and which might be most useful for your organisationToo much or too little data? Applying analytical tools to speed up business processesUtilising AI and ML to support credit assessments – use casesElectronic documentation – what can be improved?Are these solutions interoperable? What ...

Digital Innovation in Commodity Risk: What can we expect?

PANEL: Moderator: Eddie Tofpik, Head of Technical Analysis & Senior Markets Analyst, ADM Investor Services International Ltd. Saurabh Goyal, Founder & CEO, Phlo Systems Hassan Al Alawi, Senior Advisor & Risk Professional PANEL DISCUSSION: Digitalisation in commodity trading: Where do we stand? What does it mean for risk management to ...

360 Degree Risk Management in Complex Times

From geopolitics to inflation, market volatility to climate change, cyber attacks and more – there has never been such a vast array of risks facing commodity trading professionals. To not just survive, but thrive in these uncertain times, new approaches to risk management must be developed and deployed. Our brilliant speakers will tackle key topics ...

Ukraine Invasion Exposes Weaknesses of Global Integration of Commodities

A sustainability expert, an HR professional and risk professional talk about how tomorrow’s “ideal” company will look and function. Abide by ESG Covenants to be more investment worthy. Full recognition of end user preferences linking that back to production and throughout the value chain. Recognition of value pockets throughout the ...

Impact of Extreme Volatility on Large Trading Companies

How are company leaders positioning themselves in an era of high prices and extreme volatility? How has the war on Ukraine impacted different markets? How will this impact markets in the long term? What are the lingering impacts of COVID-19? Are supply chains springing back, and if not, how long ...

Credit in the Post Pandemic Economy

This session looks at the economic stress of the Covid-19 pandemic has put enormous pressure on companies, placing many in risk of bankruptcy, how much residual risk is still “out there” and how long will it be an issue for commodity traders, and what new forms of collateral are available ...

Commodity Correlation

This session looks at how different industry sectors drive commodity supply and demand, what sectors commodity traders should be watching, and how trends will in areas like construction, aerospace, building products, commercial services, electrical equipment and more drive supply and demand in commodities