Risk Management

Cultivating Financial Resilience: Credit risk trends in agriculture in 2024 and beyond

Join industry leaders for a deep dive into managing political and counterparty risks in Agri commodity trading. Gain insights on KYC, risk management innovations, and strategies to protect and advance your business.

Advances in Risk Technology – Commodity Risk & Finance 2024

Explore how CTRM/ETRM systems adapt to modern traders’ needs, AI’s role in risk assessment, and the evolution of data management and security with top industry experts.

“Management of Political Risks” by Marc-Felix Otto, Partner at The Advisory House

Learn how to navigate and thrive amidst rising political risks with “Management of Political Risks”. Discover strategies for competitive advantage, risk quantification, and practical insights for companies in uncertain times.

360 Degree Risk Management in Complex Times

From geopolitics to inflation, market volatility to climate change, cyber attacks and more – there has never been such a vast array of risks facing commodity trading professionals. To not just survive, but thrive in these uncertain times, new approaches to risk management must be developed and deployed. Our brilliant speakers will tackle key topics ...

Ukraine Invasion Exposes Weaknesses of Global Integration of Commodities

A sustainability expert, an HR professional and risk professional talk about how tomorrow’s “ideal” company will look and function. Abide by ESG Covenants to be more investment worthy. Full recognition of end user preferences linking that back to production and throughout the value chain. Recognition of value pockets throughout the ...

Credit in the Post Pandemic Economy

This session looks at the economic stress of the Covid-19 pandemic has put enormous pressure on companies, placing many in risk of bankruptcy, how much residual risk is still “out there” and how long will it be an issue for commodity traders, and what new forms of collateral are available ...

Risk Measures for Stressed Markets

This session discusses revisiting fundamental assumptions, improving existing models with minimal effort, and suggestions for better stress testing

Bull Riding: Hedging Strategies during a High Volatility Super Cycle

This session looks at how traders are hedging their positions in a super cycle market

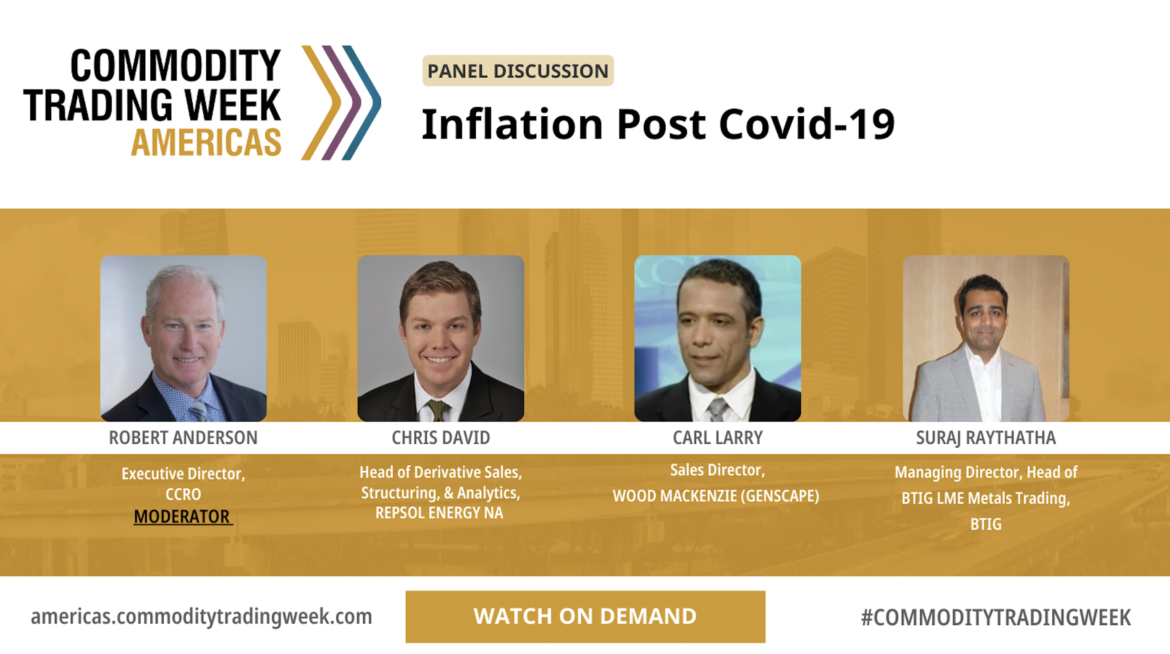

Inflation Post Covid-19

This session looks at post-pandemic blip, or a long term economic crisis, what can we expect from interest rates, and mitigation strategies