Risk

Risk Measures for Stressed Markets

This session discusses revisiting fundamental assumptions, improving existing models with minimal effort, and suggestions for better stress testing

Bull Riding: Hedging Strategies during a High Volatility Super Cycle

This session looks at how traders are hedging their positions in a super cycle market

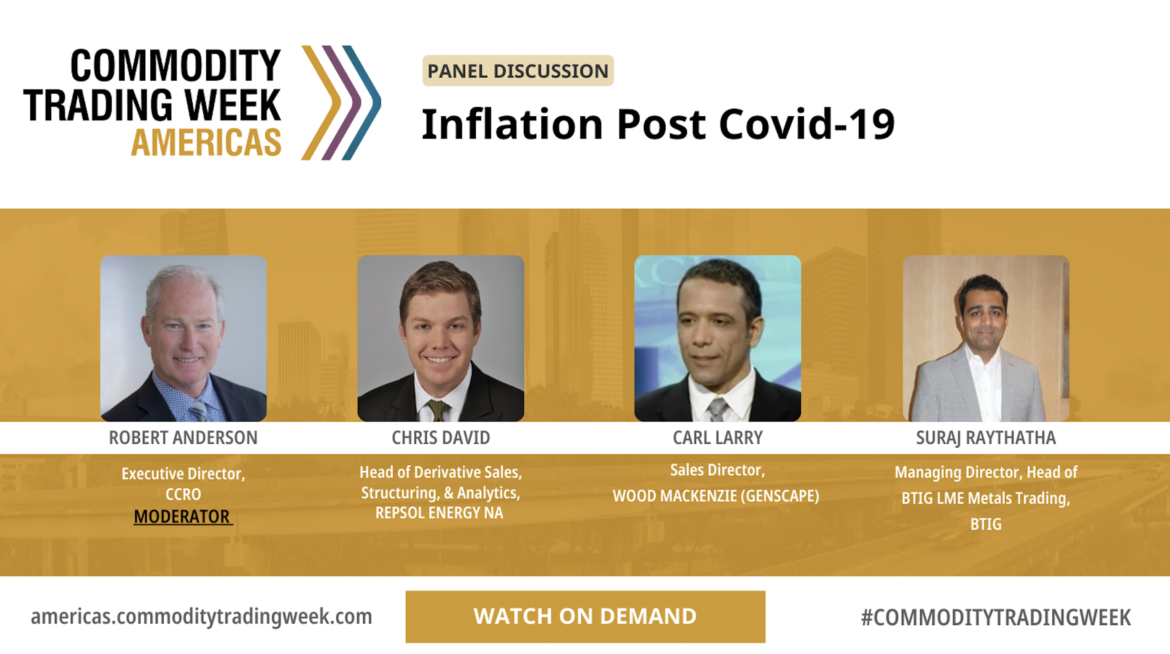

Inflation Post Covid-19

This session looks at post-pandemic blip, or a long term economic crisis, what can we expect from interest rates, and mitigation strategies

Regulatory Outlook

What are the major initiatives planned by US and EU regulatory bodies? Sanction updates in key commodity markets.

Chief Risk Officer Roundtable

Produced in association with the Committee of Chief Risk Officers (CCRO). Senior risk executives discuss the major issues on their radar, including: Volatility ESG LNG Markets Credit …and more

Turbulent Times Call for Advanced Risk Management: Practical Case-Study of a Food Company

• Prices of natural gas are currently at an unprecedented high. Direct costs of food companies went up but also indirect costs as fertilizer products want up as well. • How to valuate embedded hedges like accumulators • Long term risk – what can happen with your cashflow in 2023

Real Time Risk Management in Ultra-Volatile Times

This highly practical webinar will bring together some of the commodity trading sectors foremost risk leaders, to highlight the greatest dangers on the horizon, and how new cutting edge technologies can not only guard you against these dangers, but to also provide you with an opportunity to securely thrive and ...

Maritime Risk Mitigation 4.0 – From Compliance to Decarbonisation

Maritime Risk Mitigation 4.0 – From Compliance to Decarbonisation webinar is bringing together experts to explore the continuously evolving maritime ecosystem, focusing on new regulations and environmental trends.

CONTROL AND RISK REPORTING: BEST PRACTICES TO MITIGATE OPERATIONAL RISK

• Defining a truly data driven company: what is the architecture behind it? • Fostering Data culture in your organisation- what is important and What skills are needed to drive data strategy? • A deeper look into standards, platforms and processes • What can commodity trading learn from other industries?