Supply Chain Management

Dycotrade: Commodity Trading Market Trends and Outlooks

Sustainability in commodity trading is crucial, focusing on ethical sourcing and reducing carbon footprints. Digital transformation, like blockchain, enhances efficiency, while geopolitical tensions and renewable energy transitions significantly impact the market.

Commodity Forecasting: Navigating the Commodity Trading Universe in 2024 – Insights from Economists

Anticipate 2024’s commodity price trends amid global geopolitical shifts and supply chain recovery. Assess climate change’s impact on commodities and the growing tension between food and fuel demands, influencing market prices and availability.

Enhancing Operational Excellence: The Crucial Role of Visibility in Supply Chain Management

In today’s rapidly evolving global marketplace, supply chain management has become a cornerstone of success for commodity traders and across industries business. With thinner margins on the trading side a solid grip on the supply chain can make the difference between a successful deal or a possible bleeder.

Unprecedented changes in supply chain dynamics are playing a significant part in disrupting commodity markets

Unprecedented changes in supply chain dynamics are causing significant disruptions in commodity markets. Factors such as geopolitical conflicts, global economic shifts, weather events, and technological advancements are intertwining to create volatility and uncertainty at unprecedented levels. In recent times we have seen unprecedented changes to supply chain dynamics leading to ...

From Globalisation to Localisation?

• Exploring the drivers of localising supply chains: sustainability, volatility, disruption. • Reduction in choice? Higher costs? Or the reverse? • Is this the only true way of future-proofing supply chain strategy from pandemics, disruptions and economic changes • Who really wins? Consumer, seller… or both?

Ukraine Agri Supply Chain along with what / if scenarios

• Major Grains (Corn / Wheat / Barley) MT Exported this season to date and balances available • In the case Ports still not operating / loading / exporting what “Old Crop Volumes” might still be available for loading once Ports are operational • Major Grains (Corn / Wheat / ...

Global Supply Chain Chaos Management

• Exploring the ‘perfect storm’ of supply and demand mismatch • Developing new strategies to counter the resource scarcity crisis; Manpower, machines, materials, transportation, fuel and more • The ongoing effects of Covid19 on the supply chain disruptions. When will it end? What next? • Scenario planning and future outlook: ...

Supply Chain Risk in the Spotlight

• Managing risk in volatile freight and shipping markets • Fraud mitigation strategies • What will be the impact of increasingly localised supply chains? • Examining best practises and structures for working with multi-regional operations teams

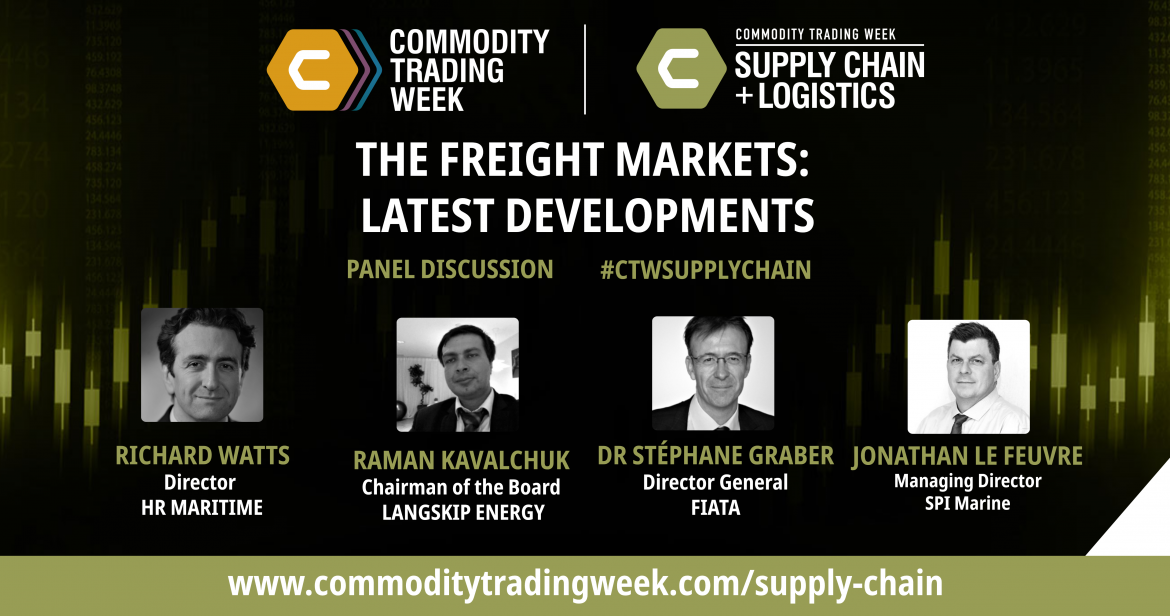

THE FREIGHT MARKETS: LATEST DEVELOPMENTS

How are emission controls going to affect freight markets? What factors are influencing the supply in freight markets? How is the demand from the various users of freight affecting freight markets?