Trading

Trouble is in the Air: The Risks of Carbon Trading

Risks associated with carbon trading and how to manage them. Fungibility of carbon credits. Implementing effective controls. Tracking credits

Impact of ESG on the Trade Life Cycle

This session looks at the industry view of ESG, essential or “greenwashing”? ESG metrics and benchmarks, and efforts towards industry standardization

Credit in the Post Pandemic Economy

This session looks at the economic stress of the Covid-19 pandemic has put enormous pressure on companies, placing many in risk of bankruptcy, how much residual risk is still “out there” and how long will it be an issue for commodity traders, and what new forms of collateral are available ...

Commodity Correlation

This session looks at how different industry sectors drive commodity supply and demand, what sectors commodity traders should be watching, and how trends will in areas like construction, aerospace, building products, commercial services, electrical equipment and more drive supply and demand in commodities

Risk Measures for Stressed Markets

This session discusses revisiting fundamental assumptions, improving existing models with minimal effort, and suggestions for better stress testing

Executive Roundtable

This session looks at the impact of sustainability initiatives on commodity trading companies, combating image issues in an increasingly climate-focused world, impact of sustainability initiatives on investment, and ESG from a leadership perspective/creating a culture of sustainability trading

Bull Riding: Hedging Strategies during a High Volatility Super Cycle

This session looks at how traders are hedging their positions in a super cycle market

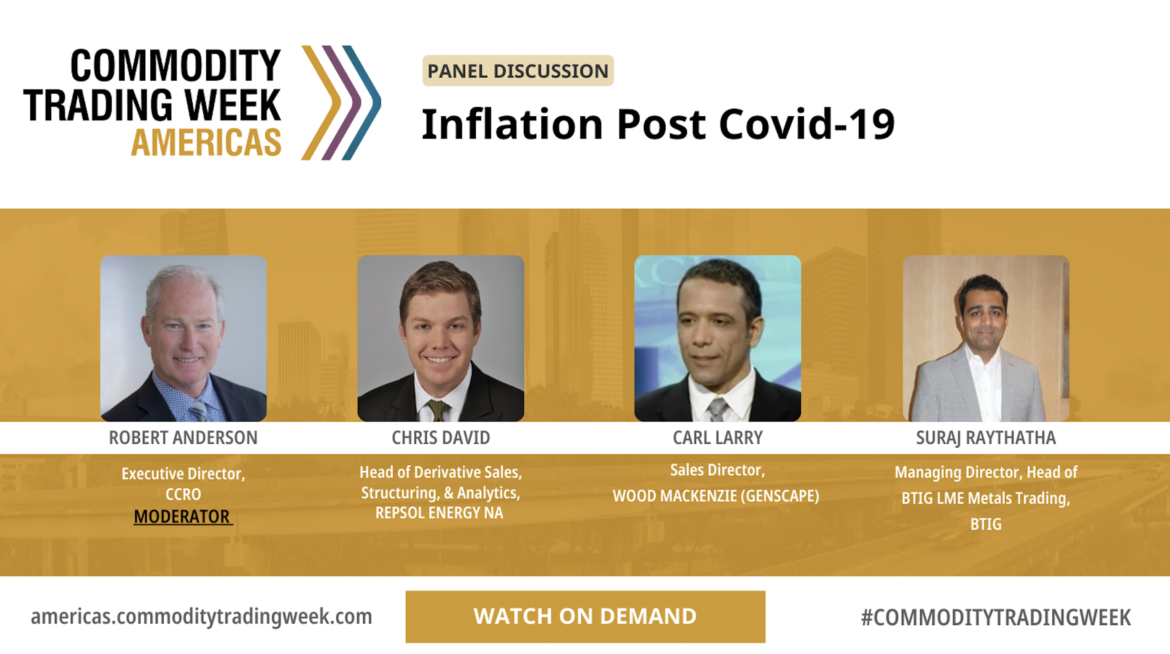

Inflation Post Covid-19

This session looks at post-pandemic blip, or a long term economic crisis, what can we expect from interest rates, and mitigation strategies

Regulatory Outlook

What are the major initiatives planned by US and EU regulatory bodies? Sanction updates in key commodity markets.